Fast, flexible financing

Apply in minutes and access your funding quickly

No impact to your credit score, long forms, or weeks of waiting. Just a quick application, and if you’re approved, funds will be in your account within 1–2 business days* so you can get back to work.

*Time for underwriting may vary based on market conditions and other factors.

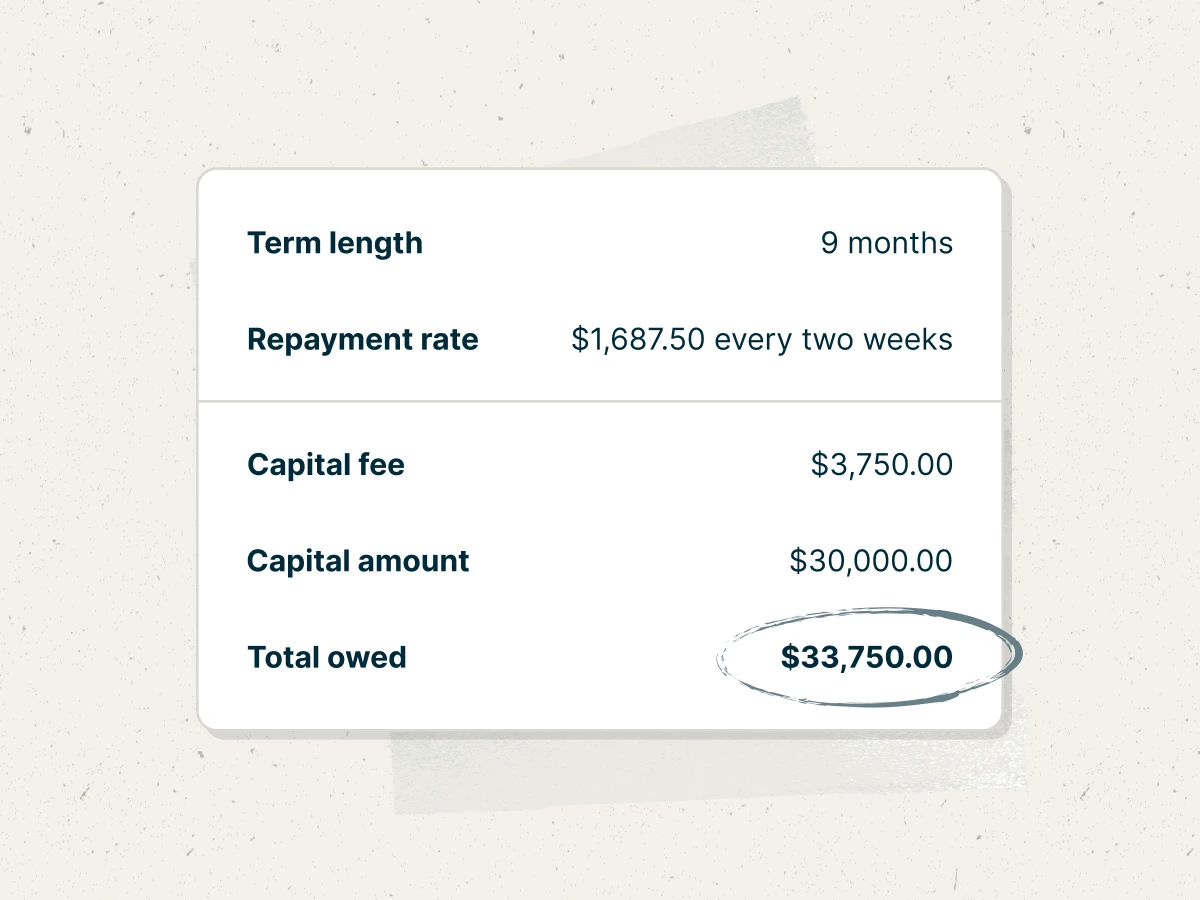

One clear cost, no surprises

You know what you’ll owe upfront. There are no compounding interest charges or late fees, so you can grow with confidence and full control over your cash flow.

Payments that work for your business

Make payments as a percentage of your sales or on a predictable fixed schedule so you always know what to expect and can invest with less stress.

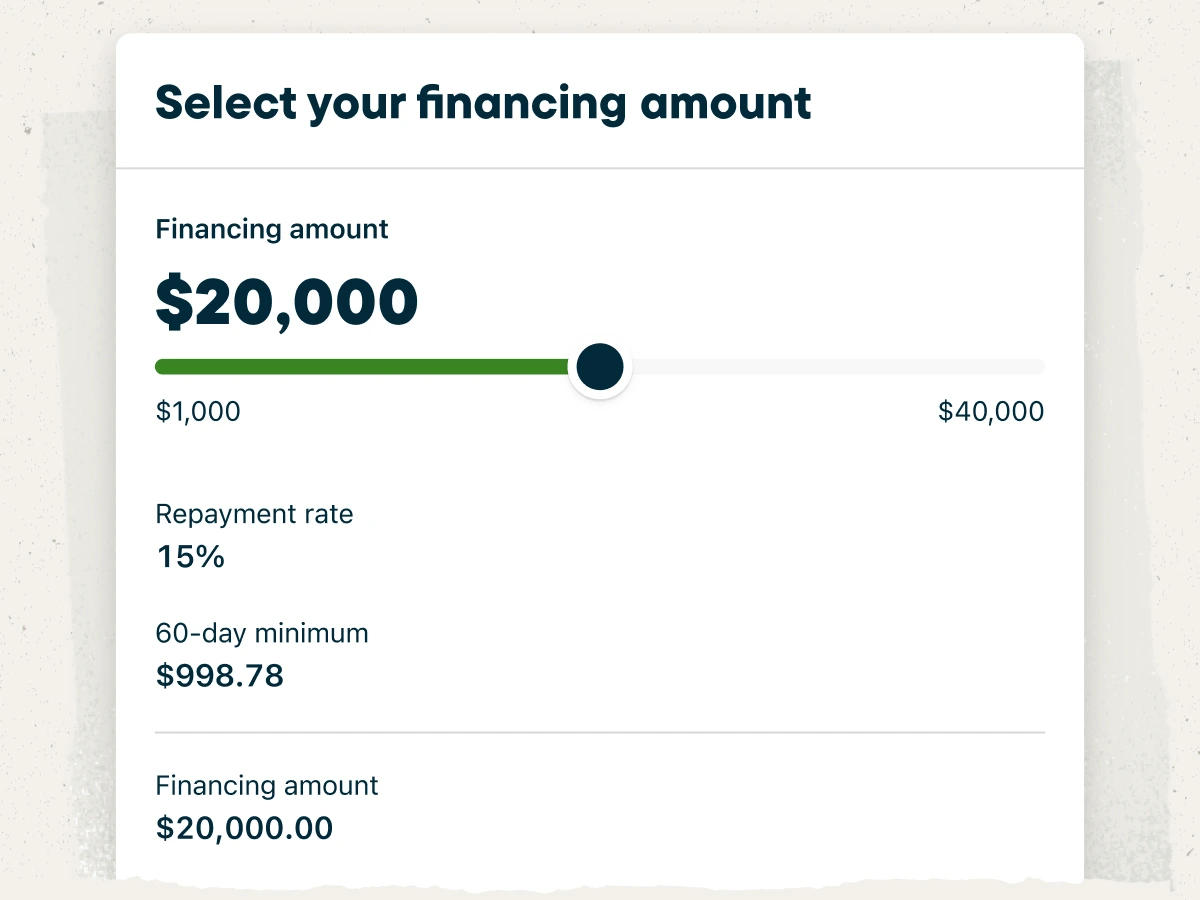

The right-sized financing to fund your next move

Choose the financing amount that fits your needs and use it your way—whether it’s investing in new tools, growing your team, or finally buying the new truck. You’re in control of how you grow.

How it works

View your pre-approved offer

Log in to your Jobber account to see if you’re eligible based on your payment history and business activity.

Choose your financing amount

You can select the financing amount that best suits your business. Your fee and payment rate are set up front based on this amount.

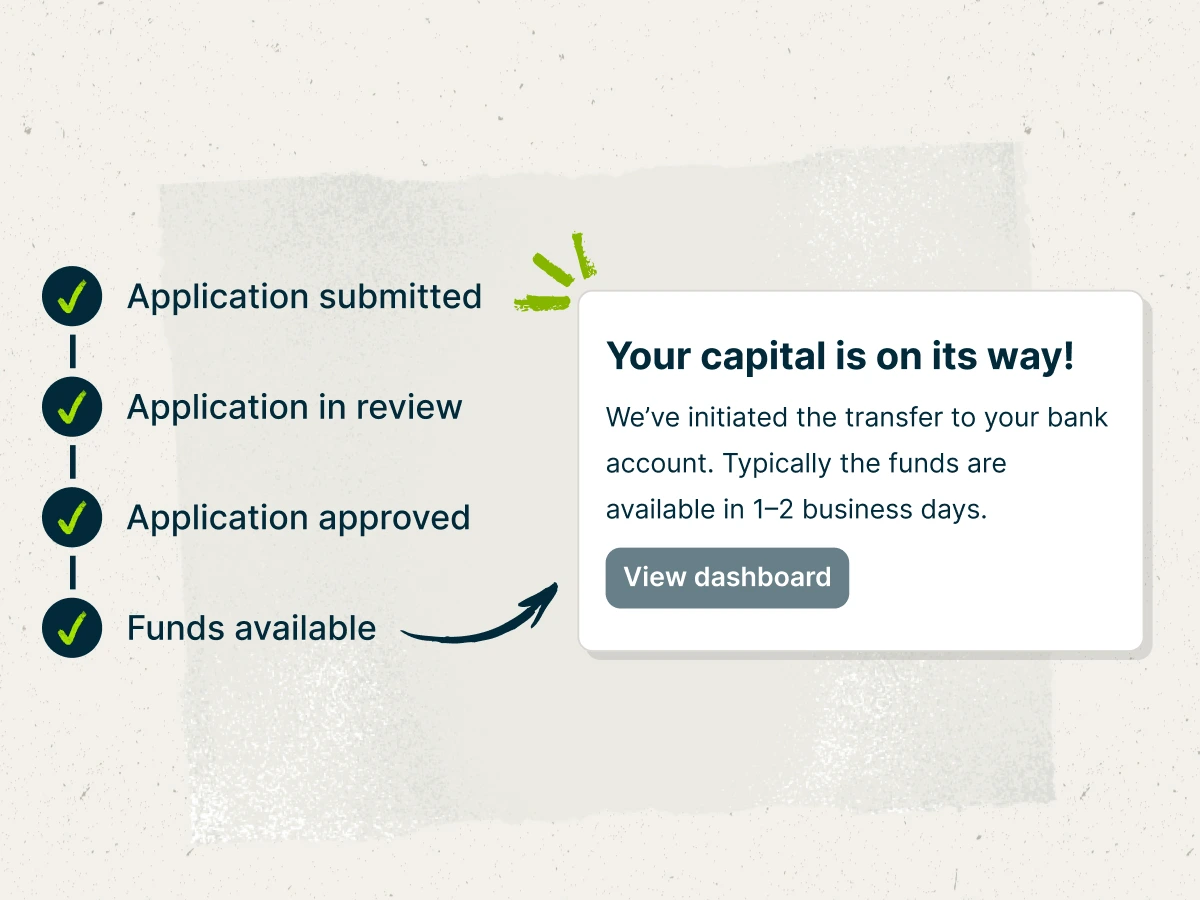

Fast funding

If approved, funds are typically deposited into your account in 1-2 business days—no long waiting period.

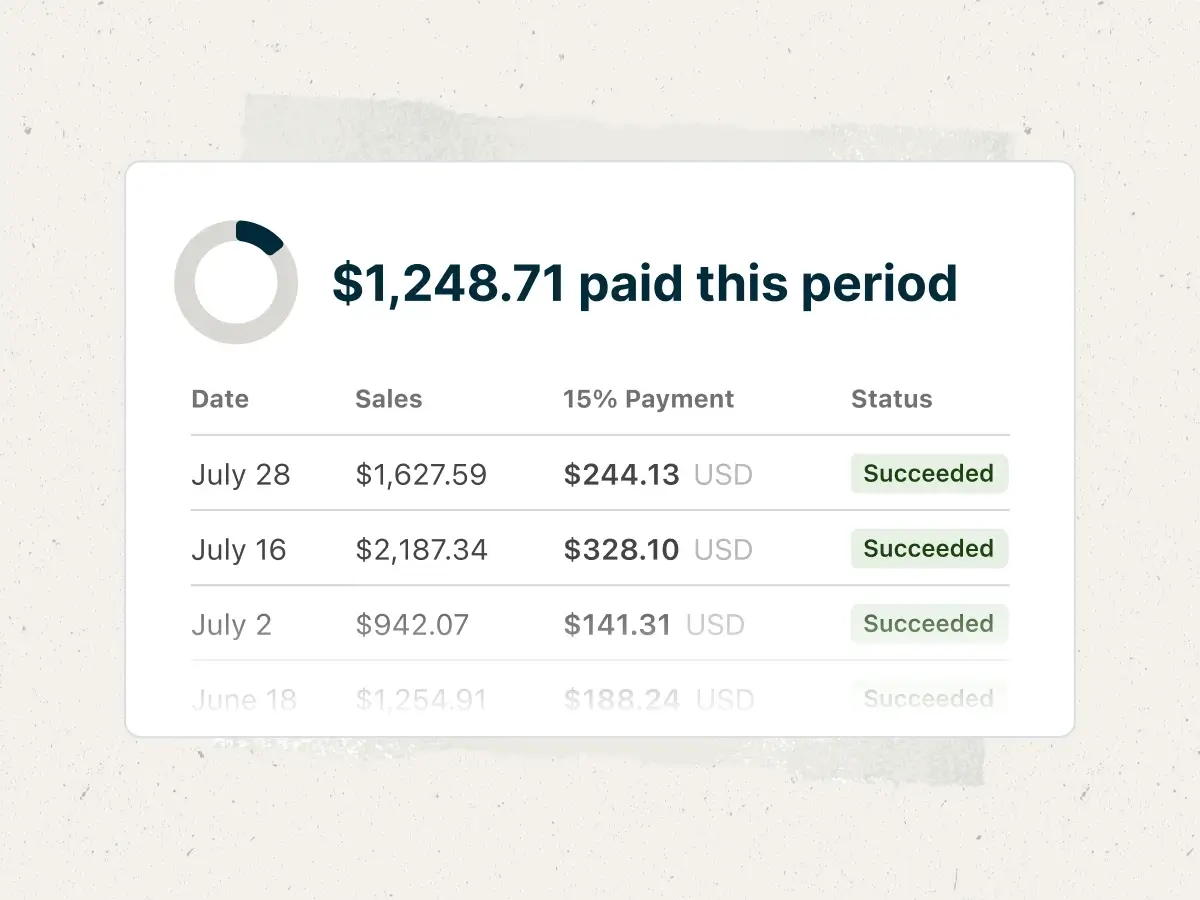

Pay automatically

Based on your financing terms, you can pay automatically based on a percentage of your daily sales or fixed amounts on a fixed schedule.

Pick the best plan for your business.

Get the tools you need to work smarter, stay in control, and grow with confidence.

Explore other features

Online booking

Turn website visitors into booked jobs automatically—no follow-up required.

FAQ

-

To be eligible for a pre-approved offer, your business must have been using Jobber for at least 3 months and have Jobber Payments enabled. Regularly processing payments through Jobber and maintaining a strong revenue history can improve your chances of receiving an offer.

-

Pre-approved financing offers are updated periodically based on your business’s performance. If you don’t see an offer now, continue processing payments through Jobber, and you may qualify in the future.

-

Yes! Through the Jobber Capital dashboard, you can make extra payments or pay your financing in full at any time without penalty.

Jobber Capital loans are issued by Celtic Bank and provided in partnership with Stripe or Parafin.

Stripe: Jobber Capital offers financing types that include loans and merchant cash advances. All financing requests are subject to a final review prior to approval. Jobber Capital loans are issued by Celtic Bank, powered by Stripe. Jobber Capital merchant cash advances are provided by YouLend.

Jobber Capital loans have a minimum payment amount due each repayment period, and if the minimum amount that you repay through sales doesn’t meet the minimum, your account will be automatically debited the remaining amount at the end of the period. If your loan has a fixed payment, Stripe stops withholding from your sales when you meet the fixed payment amount. The repayment terms for your offer will be detailed during the application process.

Parafin: All loans and offers are subject to credit approval, identity verification, and are subject to periodic review and may change without notice. Bank transfers are subject to review. Parafin merchant cash offers and advances are provided by Parafin and governed by Parafin’s Terms of Service and Privacy Policy. Merchant cash offers and advances and bank transfers are subject to review and may be rescinded. Merchant cash offers and advances are not extensions of credit or loans and they may not be used for personal, family, or household purposes.