JOBBER HOME SERVICE ECONOMIC REPORT

Jobber Tracks the Pulse of Home Service

Jobber is the leading software platform for small Home Service businesses. It supports over 300,000 professionals across industries like landscaping, HVAC, plumbing, and cleaning, helping them manage operations and get paid faster.

Home Service is a major but underreported part of the small business economy—local, labor-intensive, and essential. The Home Service Economic Report (HSER) leverages Jobber’s proprietary data drawn from its more than 300,000 users to offer a rare, real-time view of trends in consumer demand, revenue, and economic conditions across four key segments: Green, Cleaning, Contracting, and Construction.

The HSER delivers actionable insights on market shifts, challenges, and strategies, helping businesses understand what’s happening, why it matters, and how to succeed.

Trends Defining Q2 in Home Service

Q2 2025 reflected the push and pull between steady operating conditions and growing homeowner caution. Inflation and interest rates remained relatively stable, but elevated costs and weak housing activity continued to shape consumer behavior. Many homeowners are opting to invest in what they already own rather than take on large new projects, creating a steady stream of demand, though with tighter budgets and higher expectations for value.

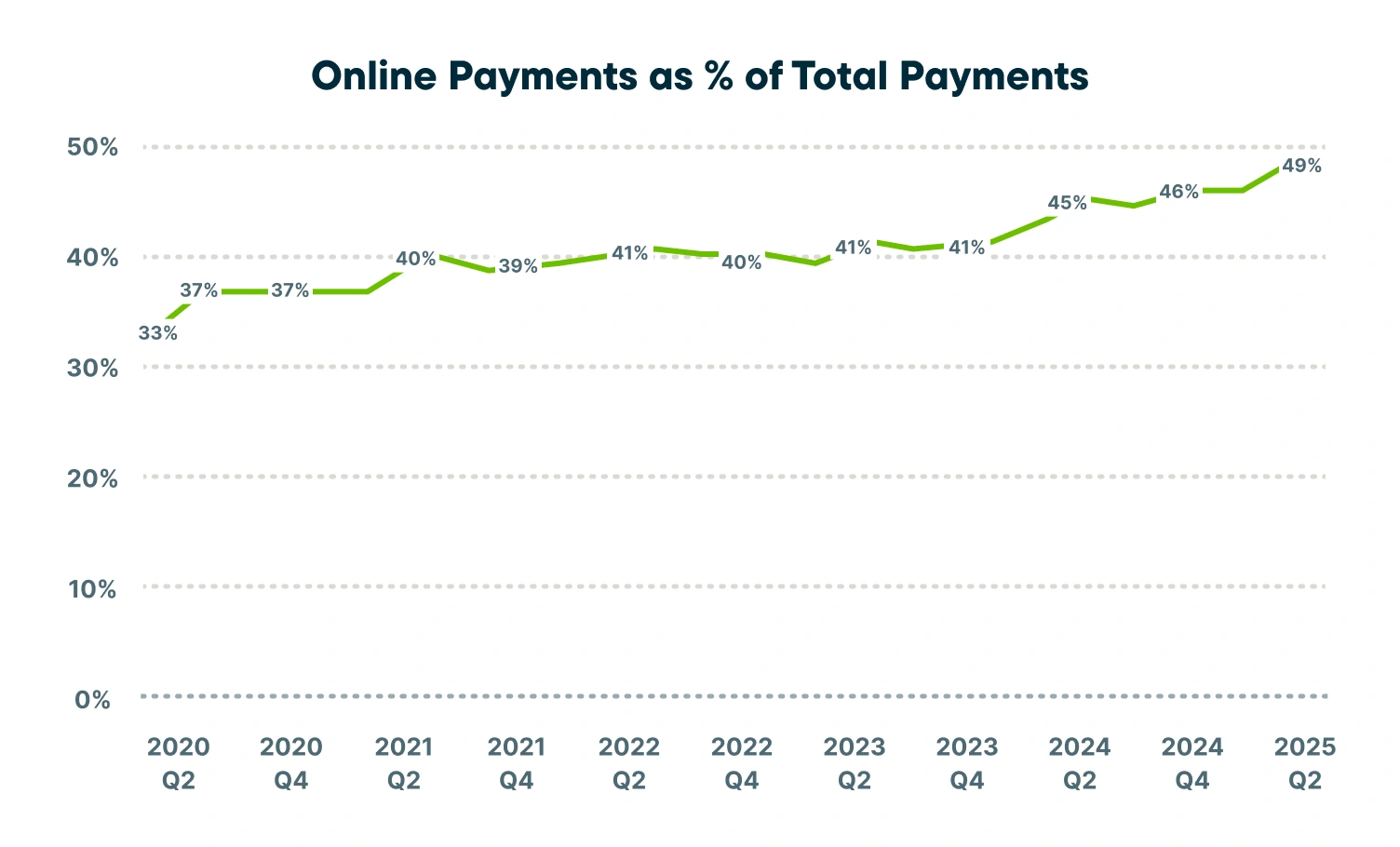

Segment performance reflected this balance. Green and Cleaning gained from June’s seasonal tailwinds, and existing client relationships appear to have cushioned revenue; while Contracting and Construction showed signs of stabilization after sluggish early months. Digital payments hit another record, underscoring homeowners’ growing preference for fast, easy ways to pay.

What’s driving change in Home Service?

- Steady economy, but growth remains cautious

Macroeconomic conditions held steady in Q2, but stability hasn’t led to acceleration. Persistently high borrowing costs and lingering economic uncertainty are keeping homeowners conservative, particularly when it comes to large, financed projects. As a result, Contracting and Construction are driven more by urgent needs than discretionary upgrades. - Homeowners are staying put and spending selectively

With elevated home prices and limited affordability, many households are choosing to stay where they are. Instead of relocating, they’re investing in maintenance, preservation, and smaller improvements. These lower-ticket projects are often more frequent, benefitting businesses with recurring service models and strong client relationships. - Seasonal lift, muted by early-quarter softness

June’s seasonal boost raised results, but overall growth stayed moderate. In Green, larger invoices hint at upselling or bundled work, while Cleaning revenue outpaced bookings, suggesting repeat customers. Contracting grew from higher-value, urgent repairs, while Construction edged up as mid-sized projects began to re-enter the pipeline. - Digital tools are reshaping expectations

Digital payments now account for nearly half of all Jobber transactions, reflecting growing consumer demand for convenience and professionalism. While adoption remains highest in recurring service and quick-turnover work, even longer-cycle industries are increasingly embracing mobile invoicing and progress billing to streamline payments and meet expectations.

The Broader Home Service Economic Landscape

Macroeconomic steadiness tempered by shifting sentiment and housing headwinds

After a strong start to the year, Q2 revealed mounting economic uncertainty. Inflation edged up 2.7% in June1, while the Federal Reserve held interest rates2, offering some predictability, but deterring larger, financed projects due to high borrowing costs. Consumer sentiment recovered slightly in June, but overall confidence remained below last year’s levels throughout the quarter3. Meanwhile, GDP contracted in Q1; a surge in imports was one factor weighing on the total, as both businesses and households shifted spending toward foreign goods, signaling caution and evolving priorities4.The housing market continued to cool: existing home sales fell 5.4% year-over-year and new home sales declined 6.6% year-over-year in June5,6. Mortgage rates remain elevated, hovering between 6.6% and 6.9%, a contrast to the sub-4% rates common before the pandemic7. Combined with ongoing affordability challenges, this has kept many homeowners in place, limiting movement in the housing market8. According to the Harvard Joint Center for Housing Studies, growth in home improvement spending is projected to slow to just 1.2% by mid-20269. Given the environment, homeowners are shifting their focus toward maintenance, repair, and improvements, areas where trusted, value-oriented service providers have the opportunity to lead.

Home Service Category Performance

Segment Snapshot: June demand lifts Q2 results across key segments

In this section, we break down Q2 2025 performance across four key segments of Home Service, Green, Cleaning, Contracting, and Construction, to see how each fared in terms of jobs and revenue. Each segment has its own seasonal patterns and is influenced differently by economic factors.

June emerged as a particularly strong month, and many businesses saw Q2 results steady or improve despite early-quarter softness.

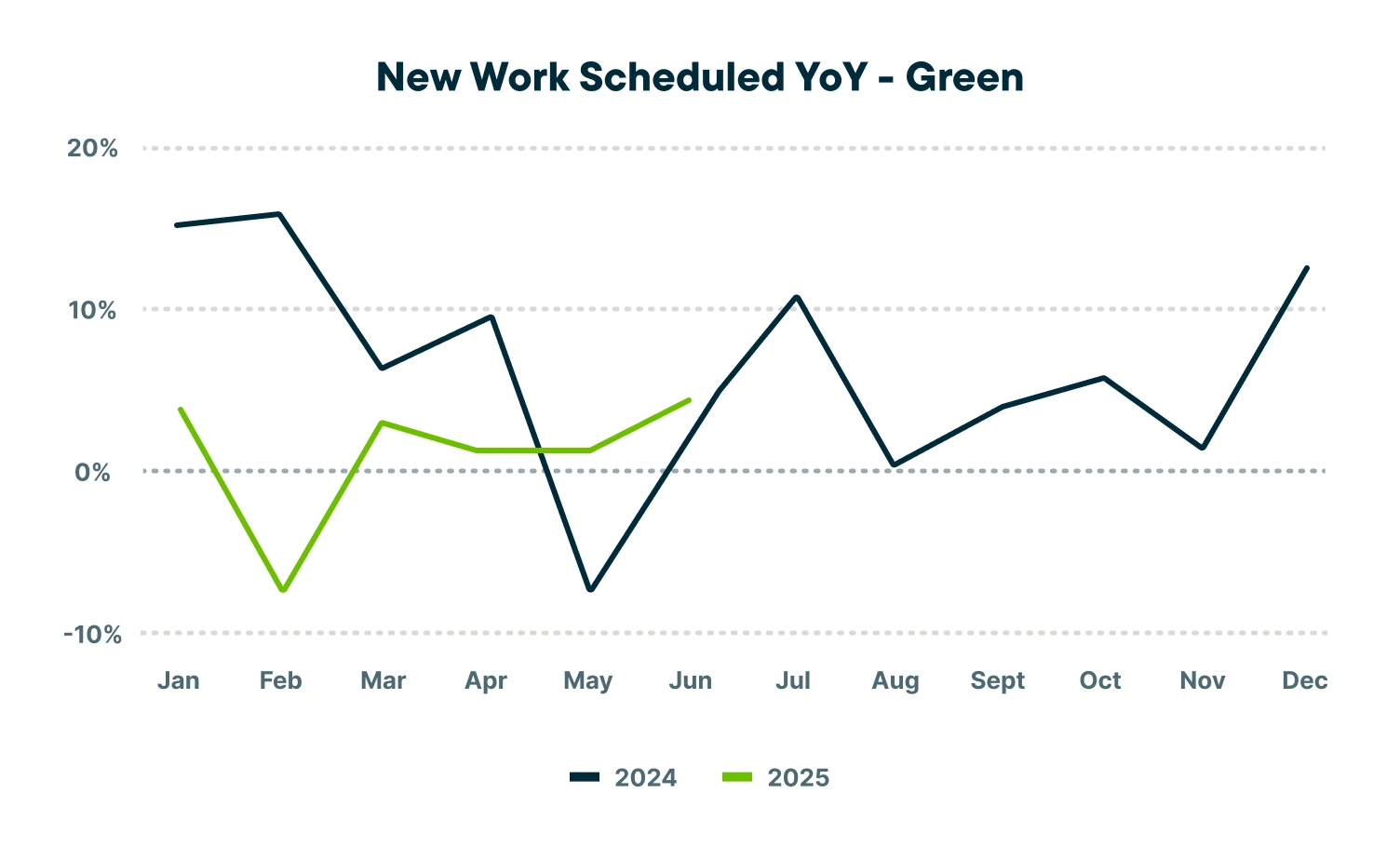

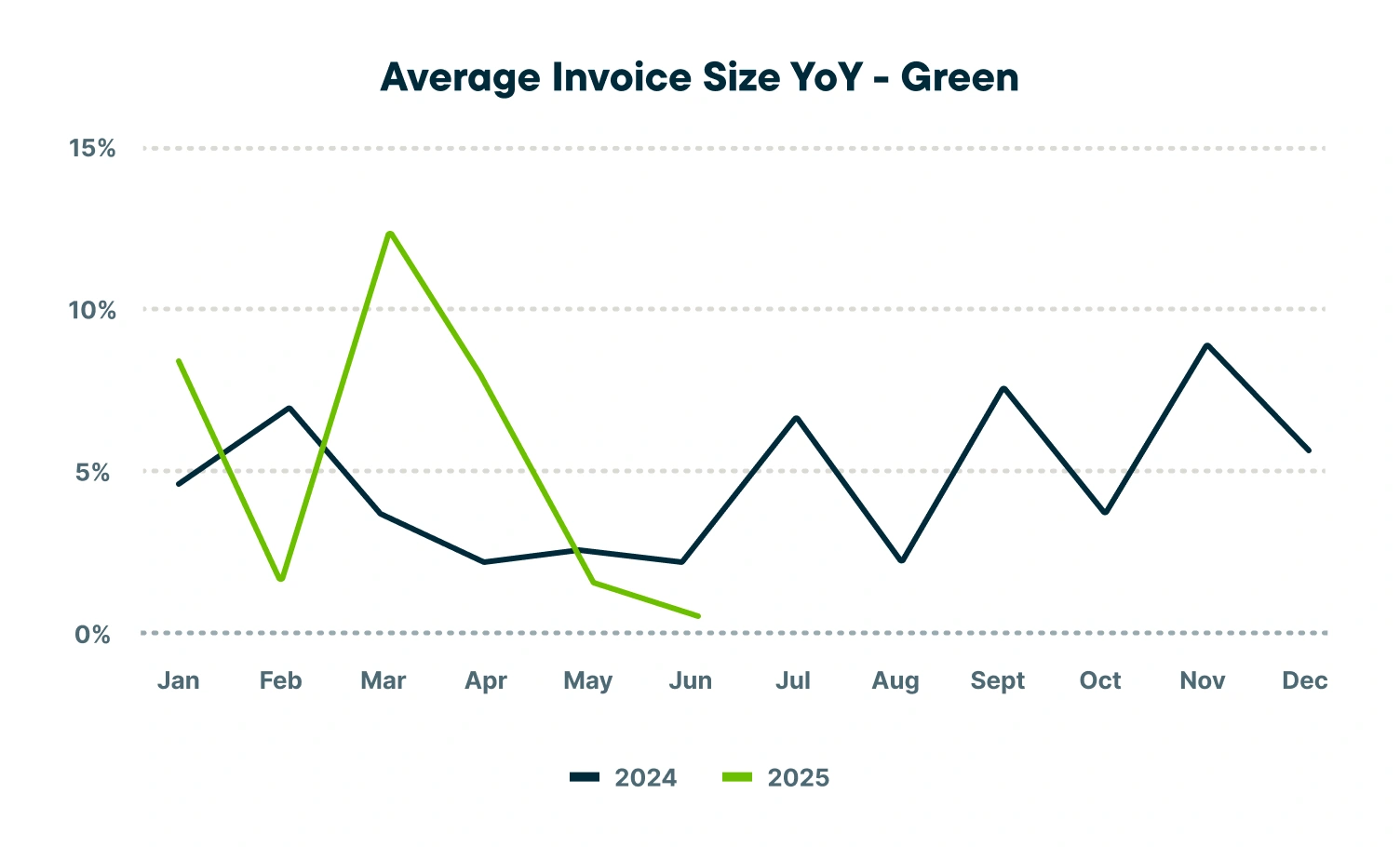

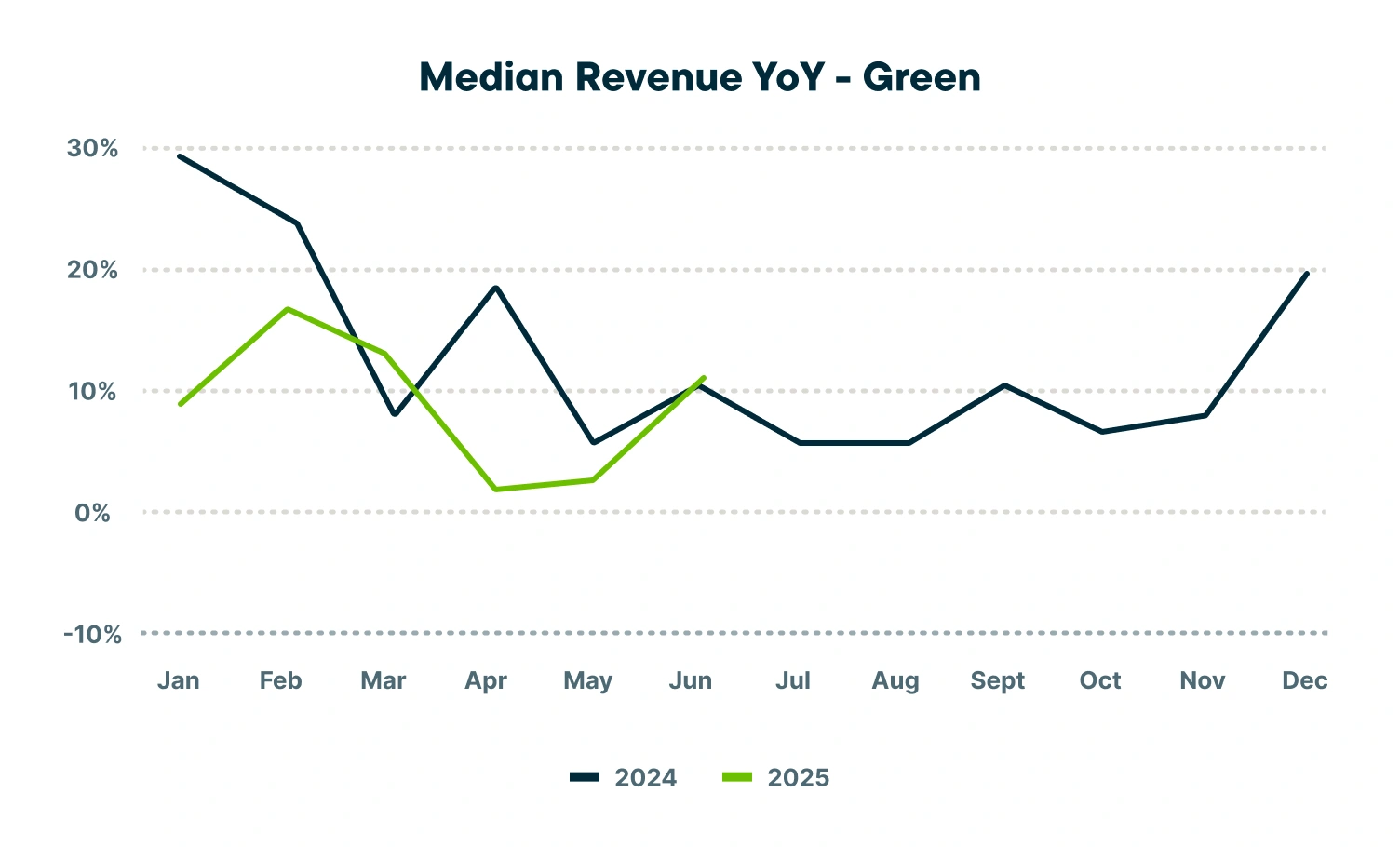

Green

Late-season surge offsets slow spring, rising invoice sizes point to packaged services and upsells

After a slower start to spring, the Green segment rebounded strongly in June, finishing Q2 with a 2.5% year-over-year increase in new work scheduled. This seasonal surge came as warmer weather and likely bundled offerings encouraged more homeowners to invest in ongoing care despite broader economic caution. Median revenue grew 5.8% year-over-year, while average invoice size rose 3.7% year-over-year.

Service pros who lean into recurring packages and early-summer promotions are likely best positioned to capture this late-quarter upswing. Heading into Q3, the focus will be on sustaining momentum through consistent client retention and upselling preventative care.

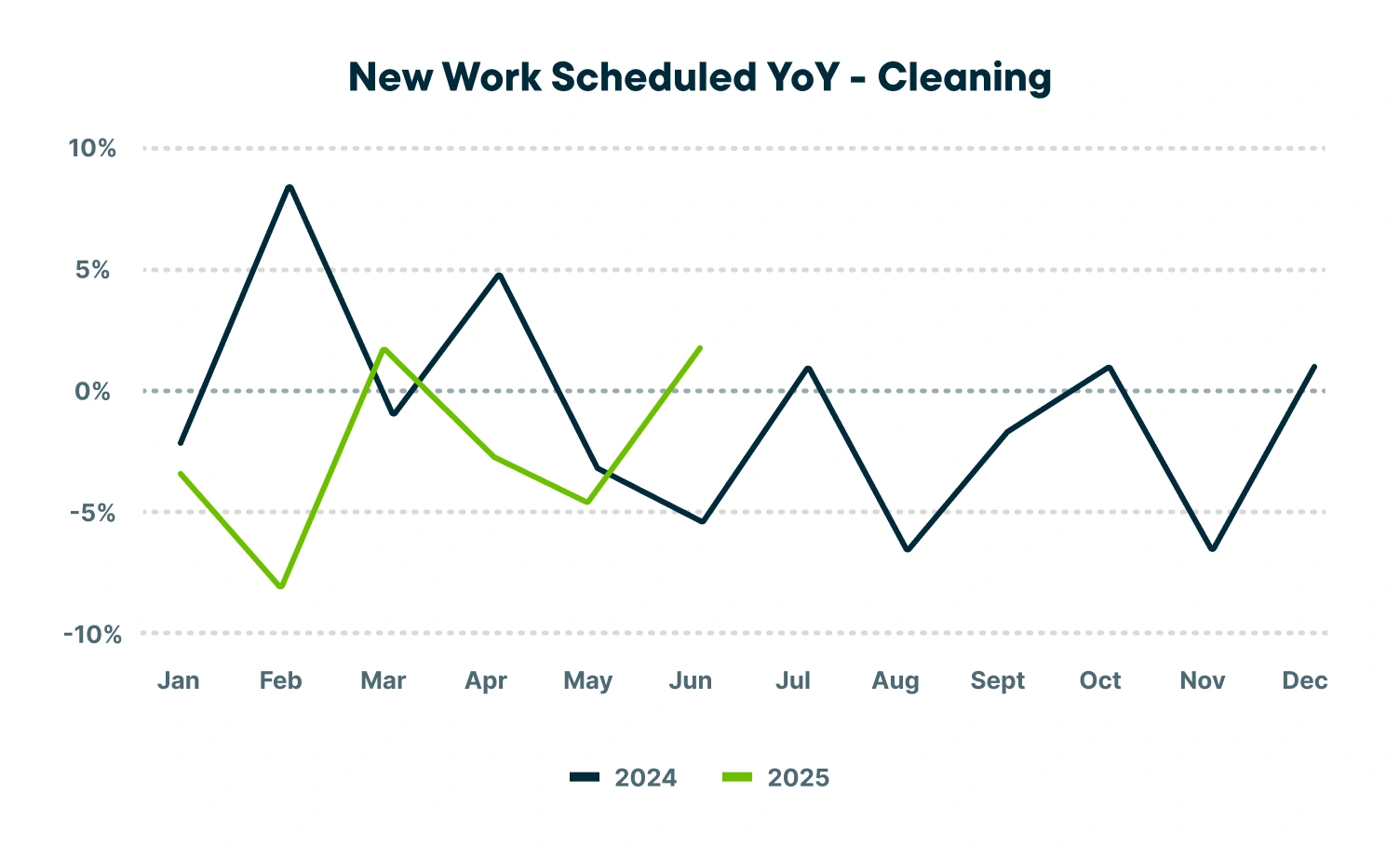

Cleaning

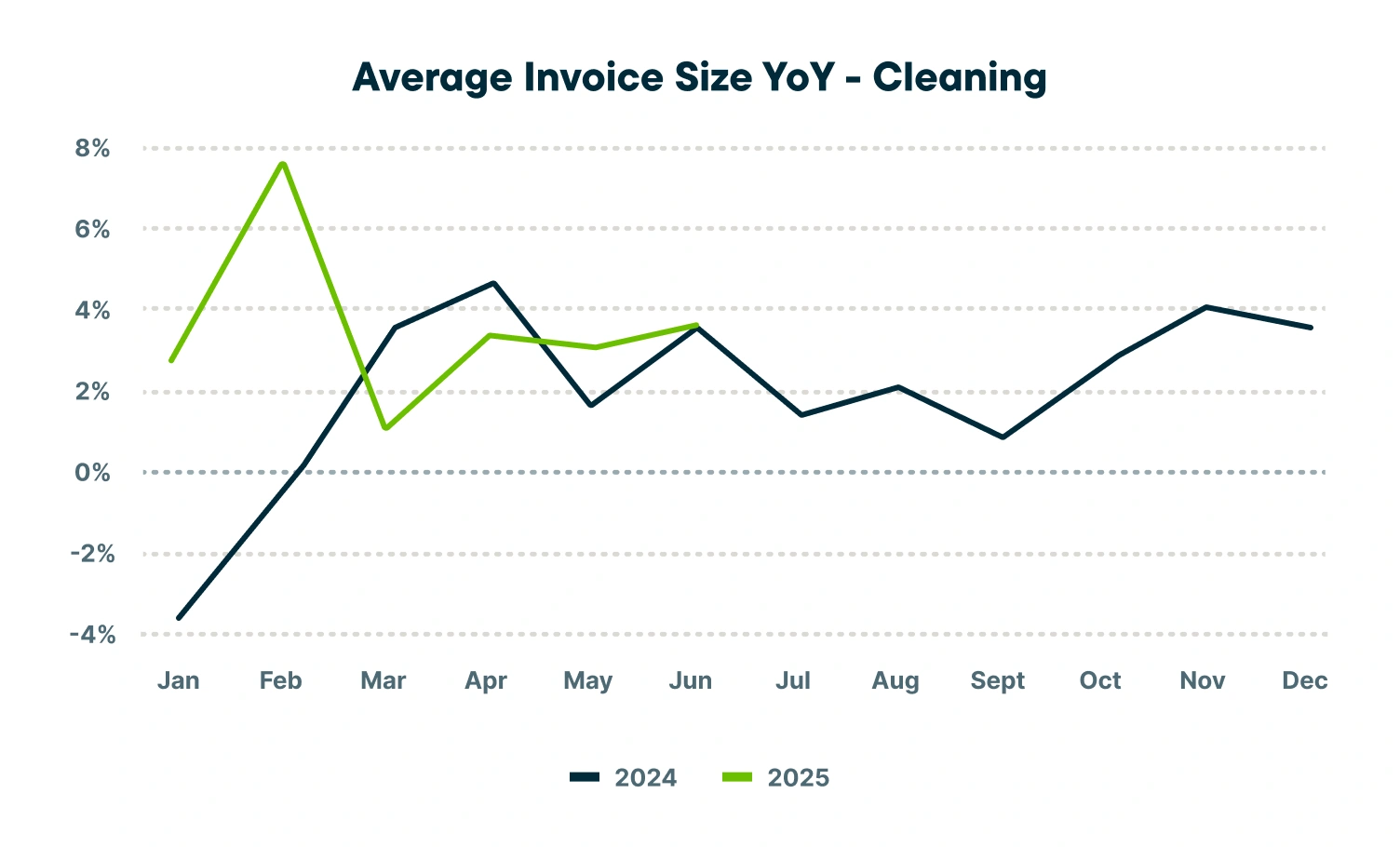

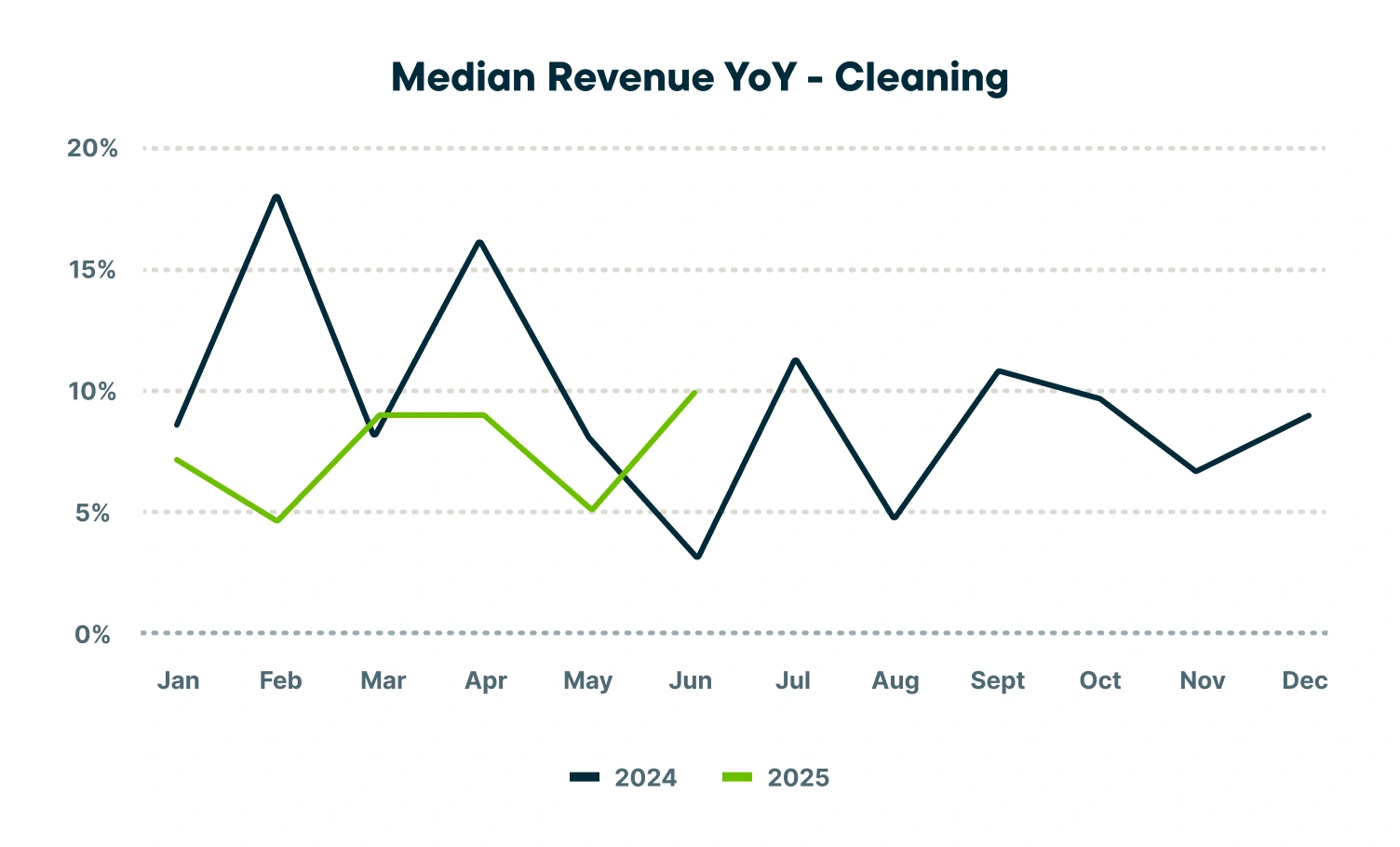

Recurring clients drive steady growth as new demand wavers

Cleaning businesses delivered strong revenue growth in Q2, up 8.1% year-over-year, on the back of solid execution and loyal customer bases. While new work scheduled declined 1.7% year-over-year, a modest June rebound suggests that price-sensitive consumers are still seeking dependable, recurring services even amid economic uncertainty. Average invoice size increased 3.5% year-over-year, with pros often upselling premium or bundled cleaning packages.

The segment continues to benefit from low seasonality and reliable recurring demand. Businesses that make scheduling easy, adopt digital payments, and communicate proactively tend to fare better on retention, helping them stay resilient despite softer new bookings.

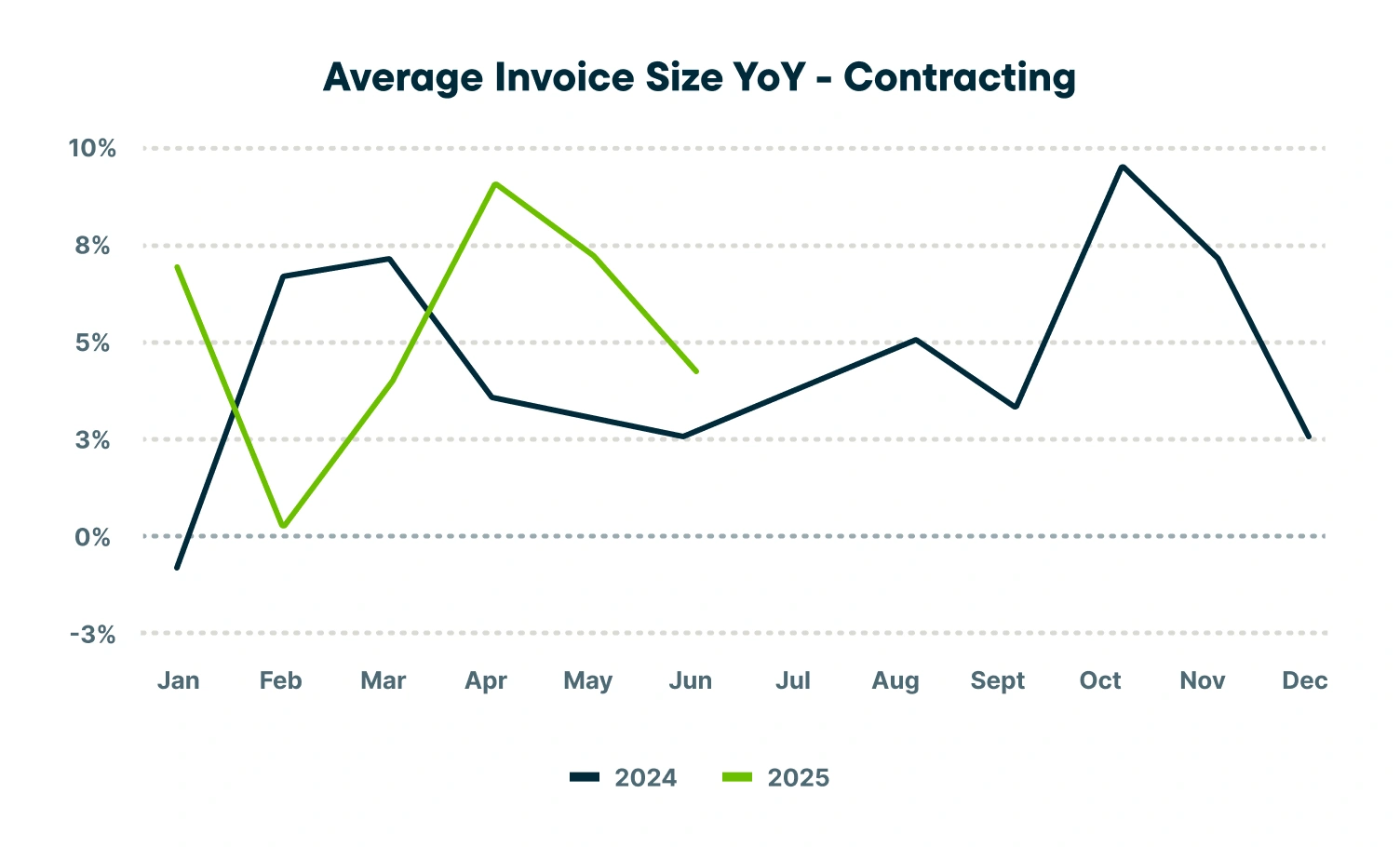

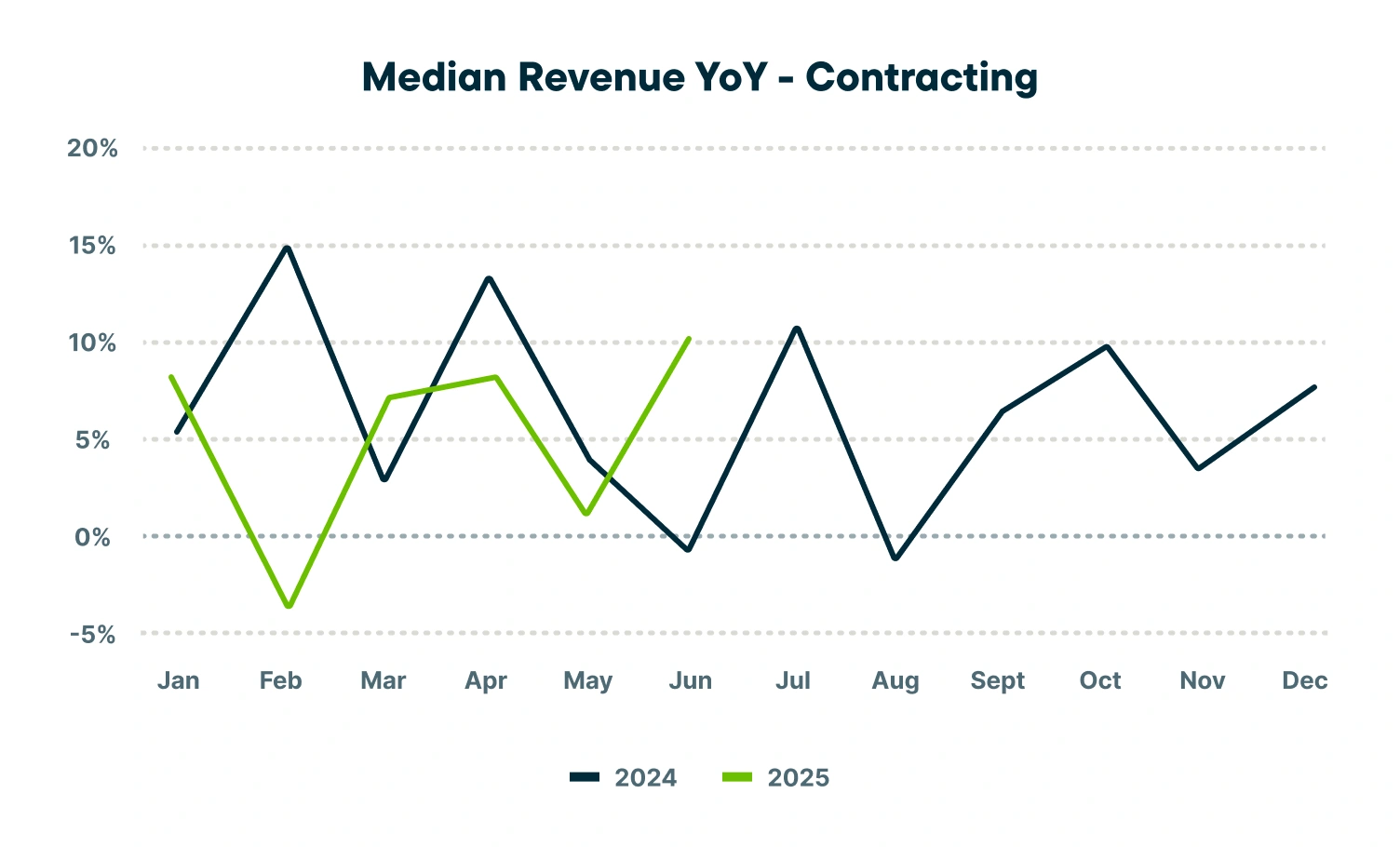

Contracting

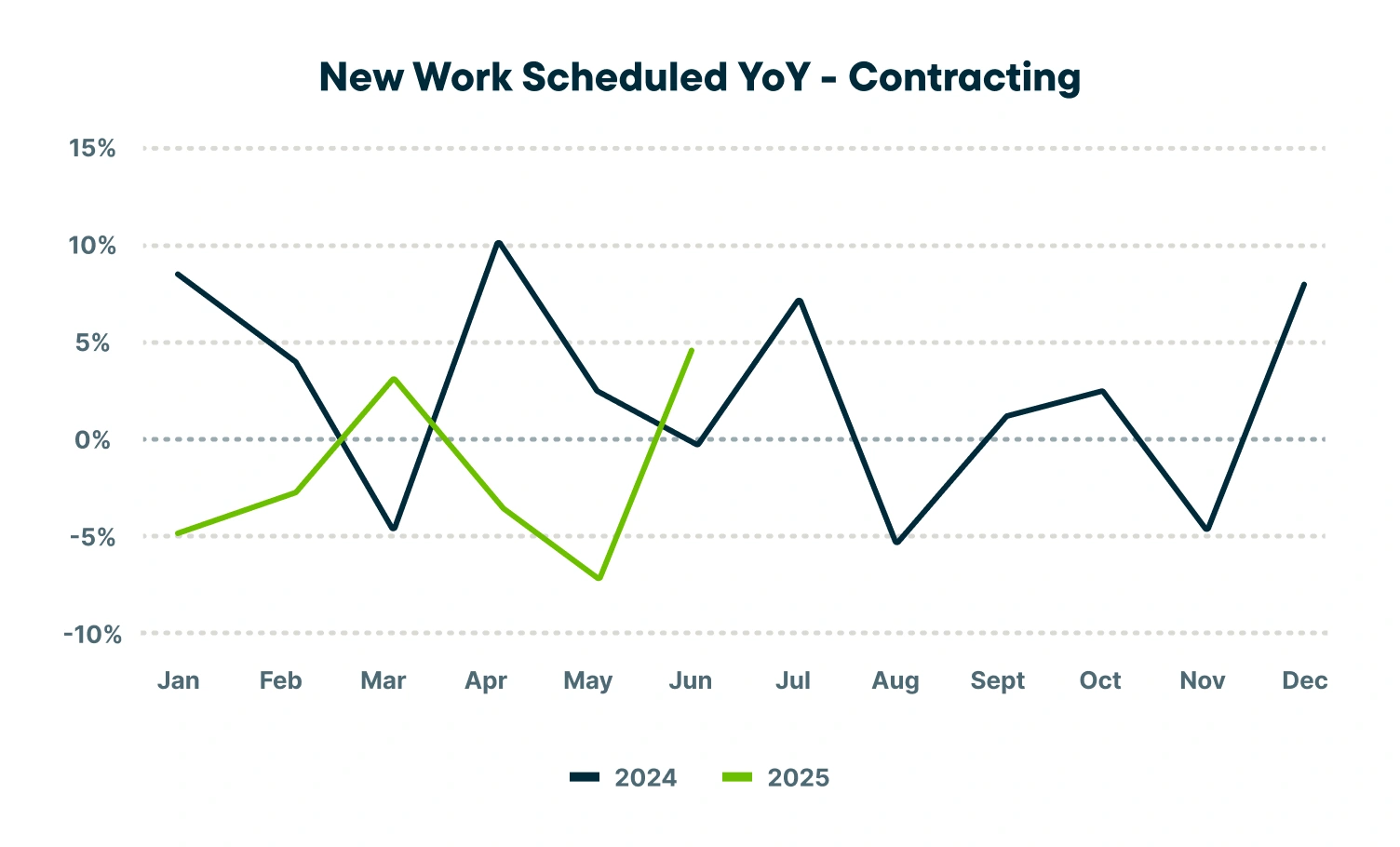

Urgent repairs sustain revenue as homeowners defer non-essential upgrades

Contracting businesses (e.g., HVAC, plumbing, electrical) showed mixed performance in Q2. New work scheduled declined 1.5% year-over-year in Q2, indicating continued homeowner hesitation around discretionary upgrades. However, average invoice size rose 6.8% year-over-year, and median revenue climbed 5.2% year-over-year, suggesting that when jobs do come through, they’re often higher-value and urgent.

After continued softness through April and May, June showed signs of stabilization as urgent needs outweighed deferral of discretionary upgrades. Providers offering diagnostic services, fast response times, and maintenance memberships appeared more resilient. The key moving forward will be balancing high-value repair work with pipeline nurturing for deferred projects.

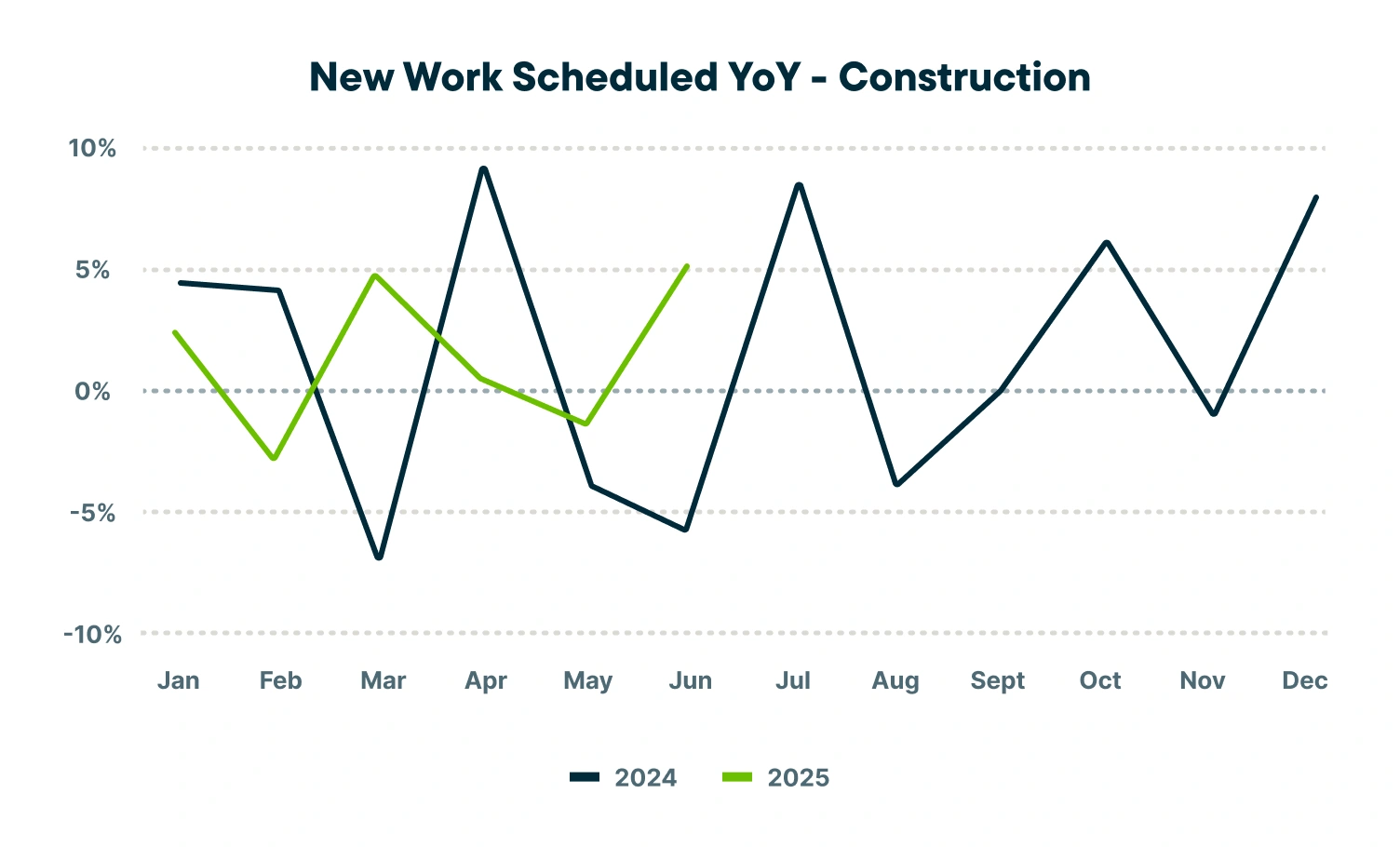

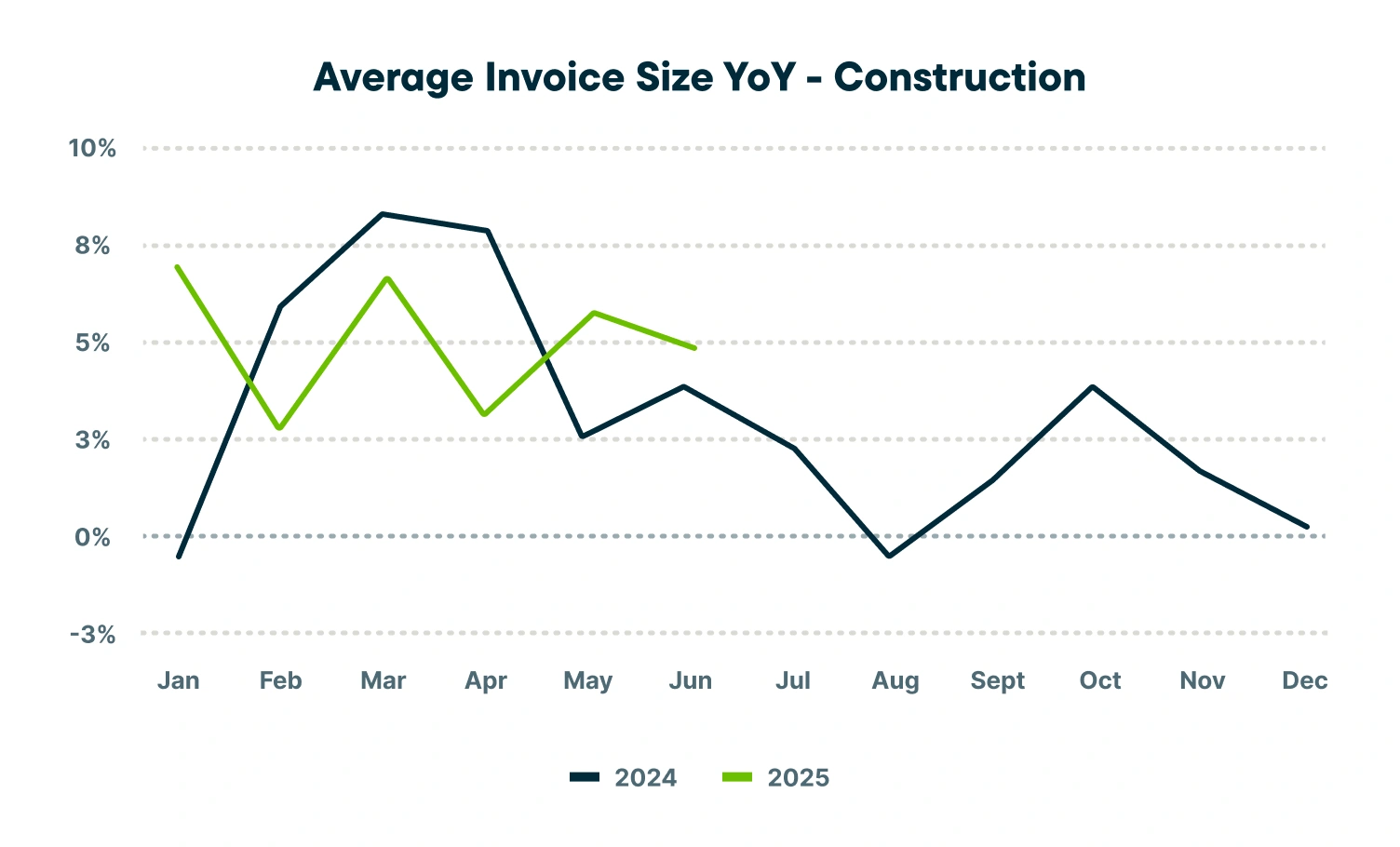

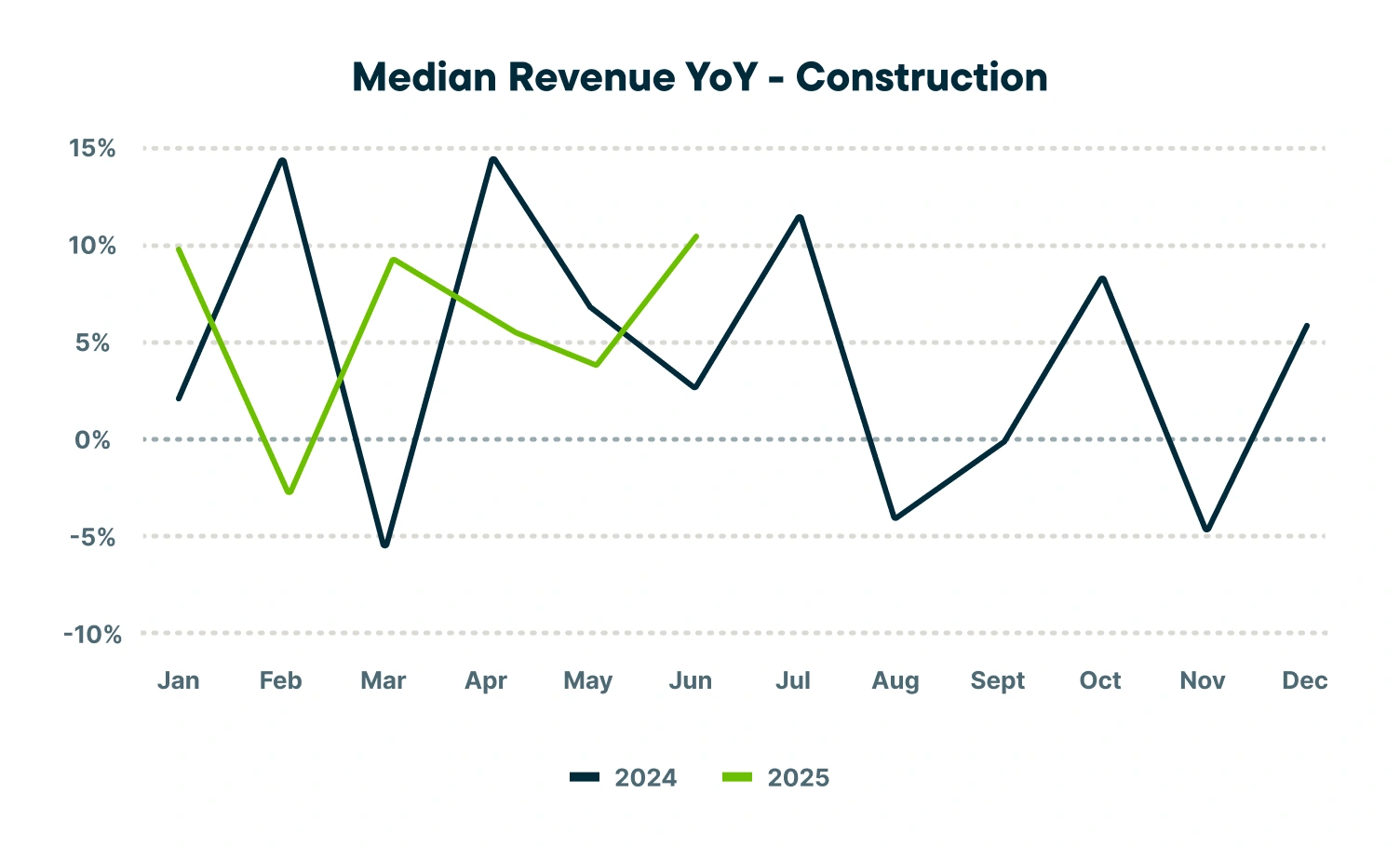

Construction

Early signs of rebound as medium-sized projects return to the pipeline

Construction services saw 1.3% year-over-year growth in new work scheduled and a 6.3% year-over-year rise in median revenue, pointing to early signs of recovery as homeowners grow more confident in committing to mid-sized projects despite high rates. Average invoice size increased 4.7% year-over-year, likely reflecting both inflation in labor/materials and a pivot toward medium-scale work.

While overall job volume remained flat, June surged 4.9% in new work scheduled year-over-year, suggesting some postponed projects are moving forward. Builders who are quick to respond and build trust with long-term homeowners may be best positioned to take advantage of this early recovery trend.

Digital Payments Gain Ground as More Service Pros Go Cashless

Digital payments reached 49% of all Jobber transactions in Q2 2025, up from 47% in Q1. This marks the highest adoption rate to date and reflects a continued shift in how home service professionals are billing and collecting payments from customers.

Several factors likely contributed to the continued growth in digital payment usage:

- Consumer expectations for mobile-friendly, tap-to-pay options

- Faster cash flow for service pros, reducing time-to-payment and administrative overhead

- Convenience and professionalism, especially for repeat customers

While adoption remains highest in fast-turnover and recurring industries, growth is also accelerating in industries where larger jobs and longer timelines are increasingly supported by digital invoices and progress-based payments.

As customers become more accustomed to seamless digital experiences in other areas of their lives, home service providers who offer digital payment options are better positioned to build trust, close jobs faster, and improve their overall cash flow.

Conclusion & Outlook

Steady conditions reward operational efficiency

Despite a more cautious economic backdrop in Q2, the Home Service sector has largely remained resilient. Segments like Cleaning and Green continued to post strong revenue gains, while Construction and Contracting showed early signs of stabilization – demonstrating providers’ ability to adapt to changing market conditions and continue serving homeowners’ evolving needs.

Looking ahead, demand will likely continue to be shaped by macro cross-winds such as high borrowing costs, shifting consumer confidence, and uneven housing activity. But for service pros who double down on dependable revenue streams, digital tools, and fast response times, there’s still room to grow. The back half of the year presents an opportunity to lean into retention strategies, optimize quoting processes, and ensure service packages convey clear value. In uncertain times, consistency, convenience, and trust remain powerful differentiators.

Methodology & Data Sources:

- Inflation data is sourced from the U.S. Bureau of Labor Statistics, via Trading Economics.

- The interest rate data is sourced from The Federal Reserve, via Trading Economics.

- Consumer sentiment data is sourced from Surveys of Consumers by the University of Michigan.

- GDP data is sourced from The U.S. Bureau of Economic Analysis (BEA), via Federal Reserve Bank of St. Louis.

- Existing Home Sales data is sourced from the National Association of Realtors, via Trading Economics.

- New Home Sales data is sourced from the U.S. Census Bureau, via Trading Economics.

- 30-Year fixed rate mortgage rates were sourced from Freddie Mac, via Federal Reserve Bank of St. Louis.

- Home Price Index is sourced from The Federal Reserve, via Fannie Mae.

- The Leading Indicator of Remodeling Activity (LIRA) is sourced from the Harvard Joint Center for Housing Studies.

- Home Service insights in this report are based on proprietary data aggregated from over 300,000 Home Service professionals using Jobber across the United States. This includes segment performance* and digital payment adoption.

*The year-over-year change in median revenue, new work scheduled, and invoice sizes were calculated by aggregating data from a cohort of businesses using Jobber since January 2023. This doesn’t include any new businesses that started using Jobber during that period.