Key takeaways:

Knowing how to calculate labor cost is key for home service professionals who want to run a profitable business and manage employee compensation effectively.

- Know what makes up labor costs. Labor cost includes more than just wages. Factor in overtime, taxes, insurance, and benefits for an accurate calculation.

- Direct vs. indirect labor costs. Direct labor costs come from employees working on specific jobs, while indirect costs cover support roles and non-billable hours like travel or meetings.

- Use a clear method to calculate total labor costs. Add up gross wages, payroll taxes, insurance, and benefits to get your true labor cost. Review these regularly to spot trends and make adjustments.

- Monitor labor cost percentage to protect profits. Comparing your total labor costs to revenue (aiming for 25–35%) helps you catch high labor expenses before they eat into your bottom line. If costs are high, review overtime, staffing levels, employee skills, and location-related factors.

- Control labor costs with smart strategies. Use job costing, offer non-monetary perks, invest in training, optimize travel routes, upsell or adjust services, and use service management software like Jobber to improve efficiency and accuracy.

For more tips like this to help you run a thriving service business, sign up for the Jobber Newsletter. Subscribe here.

Are labor costs eating into your profit? Overtime pay, inefficient workers, and over- or understaffing all take a bite out of your bottom line. If you don’t keep them in check, you could lose more money than you make.

Learning how to calculate labor costs can be the difference between turning a profit and breaking even—or worse, ending up in the red. Use this guide to take control of your employee compensation budget so every job stays in the green.

Labor costs in home service businesses:

What is labor cost?

Labor cost is the amount your business spends on employee compensation for their work during a specific period. For example, on a single mowing job or for a long-term project like a bathroom renovation.

It’s made up of more than just wages, though. Labor costs include all expenses associated with employing staff, such as:

- Overtime pay

- Taxes (like Medicare, payroll, and social security)

- Unemployment insurance

- Workers’ compensation insurance

- Benefits (like paid leave, bonuses, or retirement matching)

Depending on whether you’re calculating direct labor costs or indirect labor costs, it can also include things like paid meetings, driving time, and training.

Types of labor costs

Labor costs can be broken into two categories: direct and indirect.

Direct labor costs

Direct labor costs include the wages or salaries for staff directly providing services on a job, such as installers and technicians.

For example, if a lawn care specialist spends two hours at a job site mowing, trimming, and weeding, the total direct labor cost would be their total wages (and related costs) for the time they spent working.

Indirect labor costs

Indirect labor costs are made up of the wages or salaries that support business operations but aren’t directly billable to specific jobs.

For example, the time a technician spends driving to a job site, filling out a quote, or attending a staff meeting.

Other expenses, like administrative and office staff wages, are also indirect labor costs, since they can’t be tied to individual jobs.

How to calculate labor costs

To calculate indirect and direct labor costs, follow these steps:

1. Add up gross wages

To calculate gross wages for direct labor cost, use this formula:

Total gross wages = hourly pay x hours spent on a job (including overtime and bonuses)

For example, if a house cleaner spends five hours in a client’s home at $20/hr, plus one hour of overtime at $30hr, your calculation would look like this:

- Regular wages: 5 x $20 = $100

- Overtime wages: 1 x $30 = $30

Total gross direct wages = $130

To find your gross wage for indirect labor cost, use the same formula, but base your calculation on labor hours and pay that can’t be directly tied to a single job.

For example, if you have a full-time receptionist who receives $18/hr to answer phones, book appointments, and handle paperwork, your calculation for a week would look like this:

- Regular wages: 40 hours x $18/hr

Total gross indirect wages: $720

2. Calculate payroll taxes and insurance

Payroll taxes and insurance vary by state and business size, but usually add up to about 10-15% of staff wages. You pay these costs on top of hourly wages and salaries for each employee.

For example, if your cleaner’s gross direct wages were $130 and payroll taxes and insurance added up to 10%, you would add $13 to their labor cost.

If you were calculating indirect labor costs for your full-time receptionist at 12% of $720, you would add $86.40.

To get the most accurate number, you’ll need to check payroll tax rates in your state, as well as your business’s insurance policies. If you have an accountant or an accounting app, they typically keep track of these numbers for you and can tell you how much to include.

3. Include perks and benefits

Next, you’ll want to add in any benefits or perks, such as:

- Health insurance premiums

- Retirement contributions

- Paid time off (like sick leave or vacation)

- Training, like certification costs

- Retirement contributions, like 401(k) matching

- Wellness spending (like a gym membership)

These are harder to calculate because they can vary per employee. For example, a full-time receptionist might receive health insurance, paid time off, 401(k) matching, and a $500 wellness spending account. On the other hand, a part-time cleaner may only get paid for training time.

The easiest way to add up these costs is to apply them as a percentage to each employee’s wage. While this will depend on the benefits you offer and how they apply to each staff member, percentages often fall between 20-30%.

For example, if perks and benefits add up to an average of 25% of staff wages:

- You would add $32.50 to your cleaner’s pay ($130 x 0.25)

- You would add $180 to your receptionist’s pay ($720 x 0.25)

4. Total your labor costs

Now, you add all your numbers together, including direct and indirect wages, payroll taxes and insurance, and benefits and perks.

You can use this labor cost calculation:

Labor cost = Gross wages + Payroll taxes and insurance + Perks and benefits

For example:

The labor costs for your cleaner would be $130 for direct wages, $13 for payroll taxes and insurance, and $32.50 for benefits, or $175.50 for a single job.

The labor costs for your receptionist would be $720 for indirect wages, $86.40 for payroll taxes and insurance, and $180 for perks and benefits, or $986.40 for a 40-hour work week.

It’s also important to note that labor costs fluctuate constantly. For instance, seasonality can increase direct costs like overtime pay, or new certification requirements can temporarily impact indirect costs.

Calculate labor costs regularly to keep your budget under control. For general overviews, a monthly labor cost calculation is a good place to start so you can spot trends and make adjustments before problems arise.

You can also review your overall labor cost quarterly to monitor seasonal trends, or annually for budgeting and revenue forecasting. But if you’re trying to set prices, you may want to calculate your labor costs per job to get an average.

Calculating total labor costs can be complicated—but it doesn’t have to be. Jobber’s free labor cost calculator can help you get more accurate results without the manual calculations.

Use it to set profitable prices and rates based on real data, so you make money on every job.

How to calculate labor cost percentage

Determining your labor cost percentage helps you see how much of your revenue goes towards paying staff.

To calculate it, use this formula:

Labor cost percentage = (Total labor cost / revenue) x 100

You can use this equation for both individual jobs and to calculate a total labor cost percentage over a specific period, like a week, month, or year.

For example, if your gross revenue for a job was $500, and your total labor cost was $175, including benefits and payroll taxes, your calculation would look like this:

(175 / 500) = 35 x 100 = 35%

That means that 35% of your revenue on that job went directly to labor costs. Ideally, your labor costs would fall between 25-35%. Any higher, and they start to impact your ability to cover overhead and turn a profit.

Factors that impact labor costs

If your labor costs are too high, it could be for a variety of reasons, such as:

1. Extra overtime

Overtime pay isn’t necessarily a bad thing, but if it’s costing you profit, you may need to rethink your strategy.

Nothing wrong with working overtime if we’re getting the return on it and it’s around capacity, but if sales aren’t going up dramatically, but overtime’s going up, that’s a problem.

For example, you may see a spike in overtime during the busy season because of an increase in demand. But those overtime labor hours cost you more money for the same work.

If you’re spending a lot of money on overtime costs, it may be better to hire additional staff, train employees on efficiency, or explore piece rate pay.

2. Location

Sometimes your labor costs have nothing to do with your services or staff and everything to do with where you live. If the cost of living is high and wages are impacting your bottom line, it may be time to consider a price increase.

That way, you can still pay your staff what they need to live while making a profit.

3. Skill levels and specializations

Entry-level staff typically cost less money in wages, but they may take longer to get a job done.

On the other hand, specialized technicians require higher pay, but their experience and efficiency result in faster and higher-quality work. It’ll also save time, reduce mistakes, and boost your labor productivity.

Depending on your industry and the services you offer, it works well to have a mix of both. For example, you can hire full-time staff to take care of your most common jobs and specialized subcontractors to take on the complicated, one-off tasks.

4. Over- and understaffing

Too many employees will add up to wasted wages. Too few employees will result in a lot of overtime pay.

While you don’t want to pay employees to do nothing, you also don’t want to stretch your team too thin, causing burnout, turnover, and lower profit margins.

Try to strike a balance when staffing your business by hiring temporary or seasonal workers, outsourcing admin work, and matching labor with demand.

How to manage labor costs

To keep your labor costs under control, try these tips:

1. Use job costing

Job costing tells you how much you spent to complete a specific service. Over time, you can use that to calculate average wages for each job, identify your most efficient employees, and adjust pricing.

Variable labor costs, like hourly rates, fluctuate more than fixed labor costs, like flat rates. For example, paying a fixed labor cost can be a good option for straightforward, one-off jobs, but hourly is better for long-term or unpredictable work. Using job costing to determine when to pay employees an hourly rate versus a flat rate helps keep costs under control by showing you which jobs have consistent labor costs and which don’t.

Then, you can use that information to adjust prices and explore different pricing strategies to choose one that works well for your services, clients, and job costs, like a good, better, best pricing model or flat rate.

2. Offer non-monetary compensation

Compensation doesn’t always have to be in the form of money. It can also include:

- Flexible scheduling

- Company lunches and events

- Employee recognition programs

- High-quality uniforms

Compensate your employees with things outside of just direct cash in their paycheck. If you can’t control the money side, try to control the time side and give them their time back.

3. Invest in training

Well-trained staff members are more likely to complete jobs on time and to a high standard. And the better quality services you offer, the more you can charge.

Cross-training employees is also a good strategy for staying on top of labor expenses. When employees can handle a wide range of tasks, you wind up with a smaller, more effective team. It prevents over- and understaffing and makes scheduling employees easier.

But training doesn’t only have to cover technical skills. It’s also helpful for crews to understand how your business works in terms of profits and expenses. When employees see how timelines can impact profitability—and their paycheck—they’re more likely to prioritize efficiency.

4. Optimize routes

Indirect labor costs, like driving to and from jobs, cut into profit. While you can’t get rid of them entirely, you can manage them through things like route optimization.

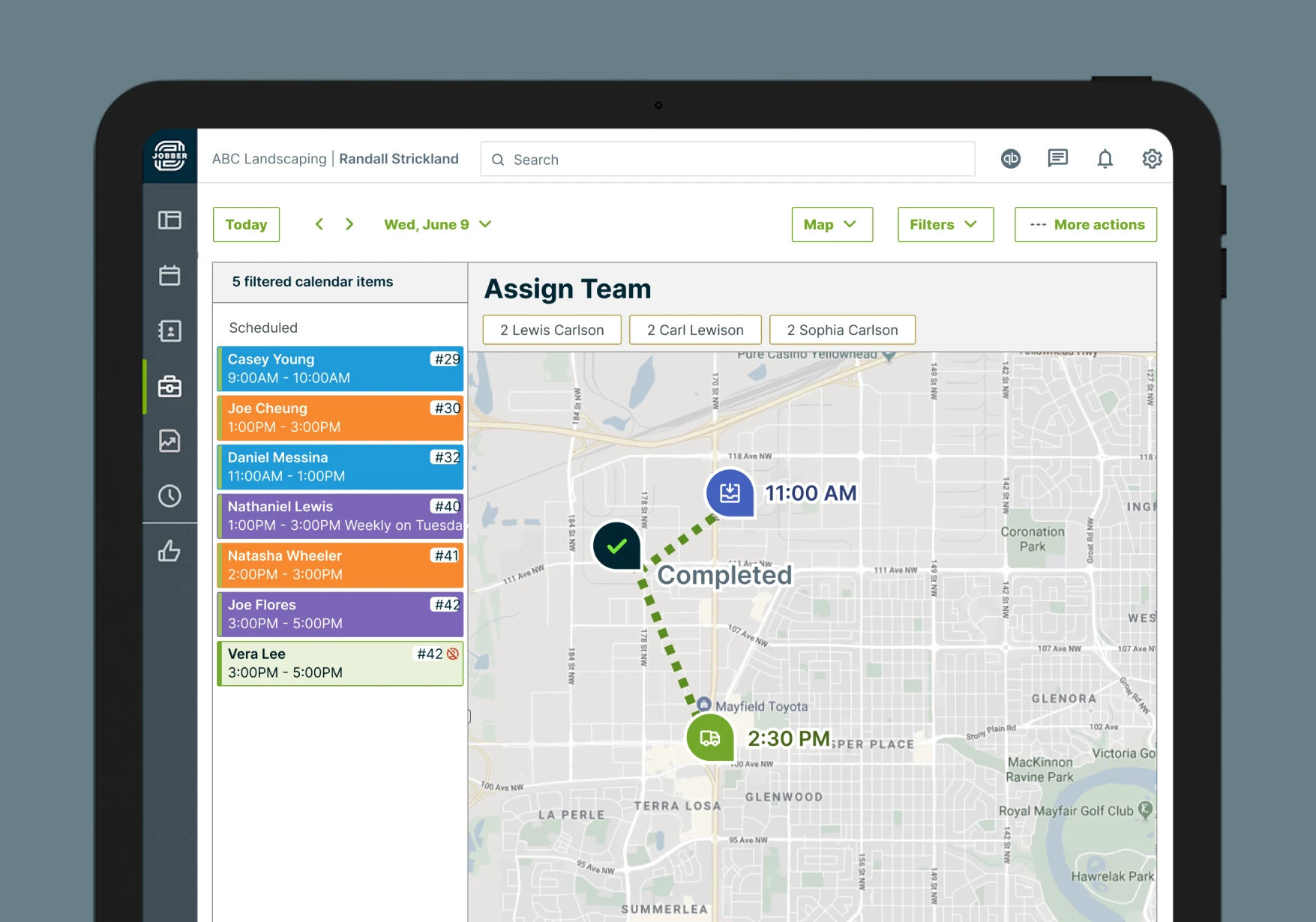

Using route optimization software like Jobber can help you plan the most efficient routes every day so your crews spend more time on the job—and less on the road.

5. Get creative with services

If you’re labor costs are already under control, but you still aren’t turning a profit, it’s worth reviewing your services.

Is there anything you offer that you aren’t charging for? Or could you turn smaller jobs into bigger ones through upselling?

Think of what you’re doing for free and charge for it. And so if you, for example, have a three-day guarantee, you could take that guarantee away and make it a 90-day guarantee and charge for it

For example, you could charge for follow-up visits, after-hours services, or specialty materials if you aren’t already. Or, you could upsell gutter cleaning during a roof repair or offer a maintenance plan after a repair or new installation.

6. Automate with software

The most effective ways to stay on top of direct and indirect labor costs is to use field service management software like Jobber to run your business. It can save you time and money on a variety of labor-related tasks, like:

- Sending quotes and invoices so staff spend less time on admin work

- Scheduling staff to reduce downtime and overtime

- Optimizing routes to cut drive times and reduce fuel costs

- Tracking time in the field to ensure accurate payroll and job costing

- Keeping job and client details in a single CRM to avoid repeat visits and keep crews prepared

Equipping your team with software like Jobber lets them focus on doing jobs well and finishing them on time instead of worrying about paperwork.