$160K in Debt to $1.2M Revenue in Under a Year

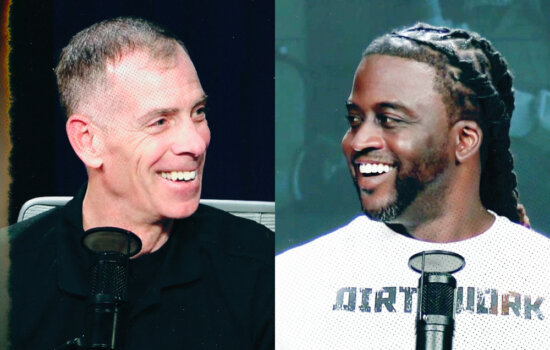

With Wilson Betances

-

Adam (00:10):

Welcome to Masters of Home Service, the best podcast for home service pros like us. I’m your host, Adam Sylvester, and I want you to crush it in business. Today we’re talking about debt, and if you’ve ever had debt, either personal or in the business, then you know what it feels like. It can feel overwhelming and it can feel like this stone wrapped around your neck, pulling you down, dragging you down every day. You can’t get rid of it and it can suck the joy out of running your business. It can also riddle you with regret. Why did I make that decision? Why did I trust that person? Why did I dig this hole for myself and how am I ever going to get out of it? Well, my guest today is Wilson Betances and he knows what it feels like to be buried under a mountain of debt, but the good thing is he actually knows how it feels to be on the other side of it to overcome, to get out of that season of life and move on. And so today is your day if you feel like that’s you. So much debt always dragging you down and it feels overwhelming. If that’s you, I want you to listen up carefully because it’s an inspiring story and also Wilson’s going to give us some tips and strategies on how to avoid that whole thing altogether. Wilson, welcome to the show.

Wilson (01:18):

Adam. It’s a pleasure. Thank you for having me.

Adam (01:20):

Yeah, so I’m really excited having you on the show today. Why don’t you tell our listeners who you are, just tell us more about you.

Wilson (01:28):

So my name’s Wilson Betances I’m based out of the Northeast. Connecticut specifically, and I’m a licensed holder as well as an electrical contractor for a few states as well as some national contracts when it comes to the renewable space.

Adam (01:40):

Okay, so you’re electrical contractor, and how long have you been doing that?

Wilson (01:44):

So I started in 2018, so we’re looking on roughly seven years going onto our eighth.

Adam (01:48):

Okay. And how did you get into electrical?

Wilson (01:52):

Well, that’s a story on its own, but I grew up in New York City, so I actually attended one of the last few vocational trade schools.

Adam (01:59):

Oh, wow.

Wilson (01:59):

So you go to high school and then you have afternoon classes when it comes to trade school. So I took up electrical curriculum. So when I graduated at 18, I already finished half of my hours.

Adam (02:10):

That’s awesome.

Wilson (02:10):

Yeah.

Adam (02:10):

So you become an electrical contractor. Tell us a bit about the backstory. You’re running your electrical business, but you start getting into some water with debt. Tell us a story.

Wilson (02:21):

I think we all can relate, especially when it comes to those first few years of contracting. I think everyone suffers from PTSD, and I liked how you said it in the beginning, you said everybody knows about debt and you know that expression, people say there’s good debt, there’s bad debt, there’s good fats, there’s bad fats. This was an avocados, this was bad debt.

Adam (02:41):

This was an avocado.

Wilson (02:42):

Yeah, this was straight trouble. This was putting myself in situation I shouldn’t have ever done. Just like what you said, why did I do this? How did they do that? And all of this led me down a path of I had to honestly stop what I was doing and say, what am I doing? Where am I going down? Where’s the end of this? And all the fingers was pointing at myself. I’m the problem.

Adam (03:05):

Isn’t that right? When we had problems in our life, we got to look in the mirror, right? That’s not the economy. It’s not that guy. Sure, there’s bad things happen outside the limits says, but the only thing you control is yourself.

Wilson (03:16):

And that’s my North Star. I mean, can we complain? Can we argue? Can we blame everybody else? Yes. Will one of those arguments get us little further? Absolutely. We might get one new opportunity, but at the end of the day, all of those are variables. And as we’re going to talk later on, as we’re going to see everything, we’re going to focus down on the principle side of things, what can I control? And you’re going to see that what you can control is like 75% of the puzzle. So even though those things are going to continue or they still might be there for the majority part, you’re still going to grow. You can still get out of any situation.

Adam (03:53):

Yeah. Well, let’s get into that a little bit later ’cause I do want to get into that some more. But a lot of our listeners, Wilson, are just like you several years ago, lots of debt. It seems to happen kind of slowly that the temperature raises over time. Suddenly you’re the frog boiling in the water, and we don’t ever jump out until it’s too late, and then we’re suddenly we’re just like, what am I going to do about this? So tell us, what was that for you? What kind of debt was it, and what situation did you find yourself in?

Wilson (04:19):

I called it the unicorn debt because as a tradesman, as blue collar, as an electrician, we’re so used to the hard skills. We were working, working, working. So I was waking up, I had work, I was working, working, working, but the money was never there. And it didn’t make sense to me at the time until afterwards. But I would wake up, buy material, put it on credit card thinking, oh, this is good debt ’cause it’s part of the business, I’m building up credit. Until they start sending you red letters. Then you’re like, wait, what happened to good debt? And then all of a sudden I’m seeing collections. I’m like, they didn’t talk about this. So I’m sending it over, talking to the GC, talking to the project manager, and they’re like, I threw your invoice up. And then you start going down that spiral, you start going down the negative side of contracting. And I call that the negative side of contracting because everybody starts blaming everybody. Oh, they’re bad GCs, they’re not paying. Instead of looking at maybe the problem was me. And then later on I found out it was me throwing invoices with a little piece of loose leaf saying, Hey, you owe me $50,000. And they’re thinking it’s a joke. Like, who is this guy?

Adam (05:30):

Gosh, okay.

Wilson (05:31):

So that’s where it all came down.

Adam (05:32):

So a lot of this stems from not collecting invoices.

Wilson (05:35):

Correct.

Adam (05:35):

Okay. Gosh, raise your hand if you’re listening right now, you can relate to that. That is such a common plight. As small business owners, we’ve got the work, we’re producing work, we’re serving Ms. Betty, we’re serving the HOA, we’re doing this, we’re doing that. And we just never get paid.

Wilson (05:51):

Exactly. And then you feel good though, because you wake up, you have purpose. I got a job, I’m going to be there at eight o’clock. You put on your boots, you strap ’em up, you stop at Dunkin’ Donuts, stop at the gas station, get your cup of coffee, you go to work, and you fall into the culture. Same stuff, different day. You know what I mean? You’re happy until the red notices start coming and you’re like,

Adam (06:12):

And then suddenly the police show up at your door.

Wilson (06:14):

Yeah, actually, the state marshals.

Adam (06:15):

State marshals.

Wilson (06:16):

State marshals came to evict us. And the more I think about this now, the more it’s like there was multiple times, I should have recognized it, but we’re a good year in now, not paying any bills because money’s not coming in. I’m like, Hey, I’ll pay you when I get paid. The IRS don’t like that. That’s not a legitimate excuse. So one day I’m working, I’m in the van, and just like all of us, one of our biggest pride, true or not, is to have your wife stay at home. A lot of us, if we have that opportunity, we want them to stay at home. We want them to be with the kids. My wife just had the baby, and now all of a sudden I get a notification, a ring from my Ring doorbell, and I answer it and I’m like, who’s this guy? So I’m like, hello? And then he goes, Hey, this is state marshals. I’m going to be honest with you. This is the worst part about my job. Can you come to the door? And I’m like, well, I’m in the road right now. At that same time, my wife opens up the door. So I’m like, oh God. And then they’re like, Hey, so we’re getting some notices that we have to evict you, you know we’re sorry it came to this. And I think for me, the worst part about it was my wife was arguing with the state marshal on my behalf, ’cause she’s like, No, he didn’t tell me this, which is a whole ‘nother story now of communicating with your spouse. But, No, my husband would never do that. He pays his bill, and every defense was just another knife in my stomach. And I’m like, dang. The point for me in all of this was the simple fact I had to beg another grown man to give me 24 hours to come up with some money and say, Hey, if I don’t have it tomorrow, evict us. We’re out. But begging another person just to stay at your home, I think that’s where everything internally just clicked for me because it made no sense on working, keeping busy, thinking you were doing good, and how everything just literally in a second just flipped. I remember I was at the job site, I’m like, Oh, today was a good day driving home. Just everything turned.

Adam (08:21):

Wow.

Wilson (08:22):

And it had nothing to do with working harder. It had nothing to do with working harder, working better, taking pride in your, it had nothing to do with that. The state doesn’t care. At the end of the day, IRS doesn’t care. The state marshal didn’t care. I was just fortunate enough where he’s like, Hey, I’m going to lunch. By the time I finish, it’s probably going to be four o’clock. I’ll come back tomorrow. So that was right there. I’m like forced. It’s not proactive. It was a hundred percent reactive. And then you know, just with human nature, things happen. People now get used to that. I’m like, I’m never coming here again. How do I change that?

Adam (08:57):

Sometimes you have to hit rock bottom for the clarity. You said for about a year, you just didn’t really quite understand how urgent this problem was until it came literally knocking on your door, and then suddenly instant clarity. I know how to solve this problem. At least it sounds like you had a plan in the next 24 hours, but we have to hit rock bottom sometimes to really get the clarity that we need to make the changes in us that life demands of us.

Wilson (09:22):

And I think you hit it two points, definition of a problem as well as I didn’t have a plan. All I know is I just had a fluff. I had to sell my, you know what,

Adam (09:34):

24 hours.

Wilson (09:35):

I needed 24. If I had 24 hours in the bank. I’m that type of guy where if you give me 20. In high school, I was called Mr. Fourth Quarter. That’s for another story though, so we’re not going there. Mr. Fourth Quarter, Isaiah Thomas, I’m ready. You give me, we’re going to make it happen. I don’t know how we’re going to make it happen. But yeah, I just needed 24 hours. And then like I said before,

Adam (09:56):

So then what did you do?

Wilson (09:57):

So I literally pulled over on the side of the highway and I’m like, What am I going to do? And then as we were discussing before, we’re saying, Where is my money? And then it’s like, okay, this GC is in Connecticut. Remember I had national contracts at that time. I’m not driving to Louisiana. I’m like, who’s local? Who can I run up on today? And then I’m like, okay, this GC, I texted him, he goes, Hey, yeah, swing by the house, but I’m not going to be home ’til five. And I’m like, it’s two o’clock. I’m sitting. Clearly the rest of my schedule,

Adam (10:29):

Nothing else matters.

Wilson (10:30):

Yeah, nothing else mattered at that point.

Adam (10:31):

Clear your schedule.

Wilson (10:31):

Laundry the dog, nothing mattered. I’m going to this guy’s house. So I show up at this guy’s house, and that’s when I start thinking about, Where am I? How did I get here? Waiting until five o’clock. The wife’s like, Hey, you want some tea? Sorry. It is at the point where I start recognizing what is a problem, define problem. And for me, problem is very simple. A problem is something that deserved your attention and you just didn’t give it. That’s when it becomes a problem. And just like you said, it’s still a problem now it’s just escalated because now it’s another person pushing that problem. But a problem is something that you needed to give. If your wife’s angry at you, I guarantee you, you didn’t do something she told you to do. If your kids aren’t talking to, I guarantee you promised something. It’s something that deserved your attention and you just didn’t give it a hundred percent. That’s when it for me, I’m like, okay, I need to recognize what did I do wrong? Now, at that time, I still didn’t know what the problem was. As he shows up, I’m in my grumpy state saying, It’s kind of messed up. I work six months and you don’t pay me.

Adam (11:40):

You’re frustrated. You’re kicking on him a little bit.

Wilson (11:42):

Once again,

Adam (11:43):

Throwing some shade on you.

Wilson (11:43):

I’m not the issue. It’s the world. And then he sat me down. Cool. I always grew up. So I grew up in New York City. You have every type of personality out there, and I always grew up seeing people just yapping back and forth. I was always afraid when someone was cool, calm, and collected, ‘cause I’m like, oh no.

Adam (12:02):

What are they hiding?

Wilson (12:02):

So when he’s just listening to me in my head, I’m like, let me start toning my tone down a little, because he is not reacting the same way I’m reacting. So I’m like, then it’s like, what’s going on? He goes, Well, let’s review this together. And I’m like, Oh no. So he calls his boss, they said, No, they have the invoices for the last six months. The reason why they didn’t pay it out is like, it’s on a piece of paper. It’s a piece of loose-leaf. You didn’t fill out the direct deposit form. You didn’t fill out the ACH, you didn’t fill out the W, all these documents. And I’m like, Oh my lord. I thought I just had to work. And then he goes, You have a whole bunch of change orders that you wrote on a piece of cardboard. And I’m like, Yeah, because you told me to do it. He goes, That’s fine. Just so you know this.

Adam (12:48):

There’s a proper way of doing this.

Wilson (12:50):

This doesn’t mean anything. So that’s when I sat down and I’m like, So what do I have to do? And then he goes, Listen, how much do you need right now? And I’m like, Well, so my total bill came out to 60. The guy told me I need a 30 to keep the house. Just to clear up some finances and legal paperwork, and whatnot. I need a 30. So I was like, I need 30 for this, and I need this agency another 20. He’s like, Alright, let’s go to the office. Let’s go to the bank. He gives me the check for 50.

Adam (13:19):

Wow.

Wilson (13:21):

At the same time, this was during COVID when everyone’s business is going out. So I’m just fortunate enough that this guy had his systems in place, his business all put together where he had that. True or not, you can’t just walk up to a normal dude and say, you owe me 50. Where is it?

Adam (13:37):

Sure.

Wilson (13:37):

You can’t even go to bank and take out 20 because then you throw off a whole bunch of red flags.

Adam (13:41):

Yeah yeah.

Wilson (13:42):

The simple fact that he had those funds available. It’s what saved me. After that, that’s when I’m like, You got to tell me what’s going on. What am I missing?

Adam (13:49):

Yeah. So I want to back up a little bit, because you said that your wife was defending you. She didn’t know about this. Is that what you’re saying? She didn’t know about all this.

Wilson (14:00):

I was lying through my teeth every night.

Adam (14:02):

Oh man.

Wilson (14:02):

We’re at dinner. I’m like, baby, it’s good.

Adam (14:04):

We’re crushing it.

Wilson (14:05):

We’re killing it. Best quarter ever. Oh yeah, no, we were making,

Adam (14:10):

And you were crushing it in the sense of production. You were doing a lot, you were closing a lot of jobs. You just weren’t collecting any money. And so these bills, personal bills were piling up and she didn’t know.

Wilson (14:20):

She didn’t know.

Adam (14:22):

How did that? What was that like? What was the aftermath of that experience for her?

Wilson (14:26):

You would think after that I’m like, Oh, all the weight’s off my shoulder. Got that check of 50. I made it to Chase. Of course, now that flagged everything saying we got to wait 22 days for this check to clear. So now it’s that next level. Well, I got a notarized letter. I sent it to the guy and he’s like, I’m cool with that, the state. So I had money for that. And then my best friend became a lawyer after that. I talked to that dude just before, go back to my wife. You would think all that weight just lifted off my shoulder, right? No, because then as I’m starting to drive home, I’m like, I have a whole ‘nother problem attention that I should have been giving a long time ago. So then I’m thinking, how am I going to address this? Am I ready to address it? I’m going to be honest, half of me was like, You got to lie through your teeth on this one. But now she saw the closet’s open.

Adam (15:17):

The jig is up.

Wilson (15:17):

Yeah, the jig is up. I’m caught red-handed. I can lie, but this is just going to lead to another situation. So it’s like, Okay, let’s talk. So as you’re going to imagine, I took the long way home. I took every back road. I stopped. I filled up my gas tank three times until I had the courage to go home. And that’s a whole ‘nother conversation. There’s a lot of anger, a lot of trust broken there ya know, just on so many different levels. But then at the end of it, it’s like with the check, the notarized letter, that was my only leg to stand on.

Adam (15:51):

That gives you some breathing room.

Wilson (15:52):

Exactly. I had an inch, and I can only play in that window. I couldn’t, nothing else. And then after that, I just recognized, once again, going back to a problem, it’s just attention. Attention could be any way, shape, or form. So bringing that awareness, talking to myself, talking to my wife, and then recognizing, okay, now that we’re in this bubble, now that we’re seeing through it, now we have to deal with it tomorrow. But how do we not have this happen again? And as you can imagine, your wife can make it or break it in both scenarios. So then she was Ms. Accountability moving forward. She’s like, You said you were going to do this. You said you were going to do that. So at the end of it, looking at it long-term, it’s always the best thing to come up.

Adam (16:40):

Wilson, I have a similar story. It’s not quite that extreme, but I remember several years ago we had $30,000 that we hadn’t collected. And it was a lot of money back then. And when my wife found out, she was like, 30 grand?! That’s my money. And she was right. I had never looked at it about that way before, but it’s true. That’s the money I’m going to send my kid to college with. And I’m not a bank, so you need to pay because I’m not lending you this money to the client. And so I think our listeners need to realize that collecting on your invoices, which we’re about to get to, is so important because, or it ends up with people knocking on your door and all that.

(17:16)

Okay. So how did you talk about accountability with your wife? You talked about solving the problem to make sure debt would never happen again in the future. What were some of those things that you did from then on and still do to make sure that you not just collect on invoices because it’s a bigger thing than that, but what are some things that you’ve done?

Wilson (17:34):

That’s where it took me down the rabbit hole of business, understanding where that leak could come from. And looking up at mentors throughout my life, I recognized I had to start breaking stigmas when it came to construction. There’s a lot of construction culture, construction stigmas out there, just work harder. At the same time, I’ve been doing this for 30 years, is a famous one I keep talking about. And you see contractors who’ve been doing it for 30 years, and they all have the same pride, same attitude. And I’m like, okay, the IRS doesn’t care about that.

Adam (18:05):

Same ego. Ego doesn’t pay bills.

Wilson (18:07):

So I’m like, something has to change. And I went down the rabbit hole, as you can imagine, nobody’s sleeping in my house for, well, I’m not my wife’s. Yeah, she’s definitely awake. But you start going down the rabbit hole, looking up research and understanding at the same time during the day, I’m talking with the GC that I happen to do the work for, and he’s now mentoring me. Anytime I finished a job before three o’clock, he said, Go to my office and watch my office staff. So I would just go to his office staff and just sit down and watch ’em, how they handle accounts payable, how they have a conversation, how they send an email, how they follow up. Hey, we just sent you the bill, did you receive it? And I’m like, Oh, wow. Instead of a piece of paper, and just thinking it got delivered to the right person. So I recognized all my attention, had to go out of the field. At the same time, I’m still a one-man, two-man guy in the field, so I had to balance a lot. But whenever I had the opportunity to break free, I was going to his office just to watch how he operated, not even him, just how his office staff operated the entire business.

Adam (19:07):

There’s a lot of norms out there that you mentioned. Ego is a huge one. And just buying a brand new truck for basically no reason. Now that’s a different story. I like new vehicles, but not when you can’t afford ’em.

Wilson (19:18):

Correct.

Adam (19:19):

And so there’s a lot of different kinds of debt. And yours was mostly centered around just not collecting on your invoices in a timely manner. Do you have any safeguards where you say, Hey, hey sir, ma’am, client, you haven’t paid yet, so we’re stopping. We’re going to pause this job until we get caught up here. Do you have anything like that in place to make sure that you don’t go too far?

Wilson (19:40):

Now we do. And I know we didn’t plan for this, but the company I’m working for, one of them, they just declared bankruptcy in August.

Adam (19:50):

Oh wow.

Wilson (19:51):

This is fresh. So, bankruptcy in August. And I’m like, how much did they owe us? And we, yeah, I’m looking, how much did they owe us? And she’s like, 72. And I’m like, Annie, let’s call them every day now you know we have a whole game plan on how we’re going to resolve that, but I’m happy to say two weeks ago they paid 45 of it. And I’m like, if a company’s going out, accounts payable is the last thing they’re worried about. They have their own legal stuff, they have to. So we got half of that. Awesome. But what I’m trying to say is the simple fact that I had to remove myself from the field to now focus on what the business needs is what changed everything.

Adam (20:29):

Yeah. Wilson, this is a great conversation. I want to pause for a minute to talk about why we love Jobber so much. You’re a Jobber user, so am I. How does Jobber help you collect on all these invoices we’re talking about?

Wilson (20:40):

I think the scariest part is the unknown. Sending out an invoice, not knowing if they received it, and then having that awkward conversation of, Hey, did you get the bill? And then they may say, Oh, I don’t have the money now. The simple fact that Jobber lets you know when they received it, when they opened it, when they approved it, when they pay it, that communication takes off the stress off of me personally.

Adam (21:02):

Yeah. Yeah. A hundred percent. Yeah. And you mentioned earlier your wife and the stress and all that. Jobber, you can literally send out an invoice. No more paper, right? No more paper. Losing the mail, none of that. Just invoice, email, they pay. Money’s in the bank next day. That’s the way to run a business.

Wilson (21:18):

Exactly.

Adam (21:18):

If you’re not collecting payments on your invoices with Jobber, you need to be. It can be instant. And it’s the way to cashflow your business. Go to jobber.com/podcastdeal, get the exclusive discount, and start collecting your invoices with Jobber today.

(21:32)

Just changing your mindset on how to approach your business in a much more serious way. That’s not just about doing the electrical work. It’s not just about cutting the grass. It’s not just about cleaning the house. It’s not just painting or drywall or landscaping. It’s about running a business that you can actually do for long-term, so that your wife doesn’t get sideways on you when the marshal shows up. It matters. And so I think we have to change the perspective on our business that Michael Gerber calls it, working on your business, not in your business. And so for years, you just weren’t collecting invoices. You make a couple changes. And I think those are just really important, really important changes.

Wilson (22:08):

No, and it is. That’s where I, once again, when I started going down the rabbit hole, I started working with different mentors throughout. I also work with Patrick Bet-David. He’s a big business advocate. He’s big on accountability side of things. Where the biggest leak most likely is, you. How do you remove you from your business? And that’s how the mindset you have to do. But at the same time, we’re in a unique dynamic when it comes to construction because we have that construction culture. We always say we’re good at working and we’re bad at business. Yet then people want to delegate task to their team. But once again, that culture still applies. If you pass this off to a journeyman, to a foreman, they’re bad at business. You understand? So now you’re going down the spiral world, a spiral. What we have to recognize is we have to either self-develop or delegate. So when I’m now focusing on how am I going to grow? How am I going to change things up? I start thinking of what do I have to remove myself from because I don’t have the answers, and I don’t want to have the answers. And I’m proud. But that goes against the construction culture. So this is not just a business issue, this is a culture, this is an industry issue. How are you going to tackle that? There’s so many different facets though.

Adam (23:21):

Yeah. Yeah. You touched on Jobber, and I’m a big fan of using Jobber for collecting payments because you can see all your outstanding invoices, you just see ’em right there. You’re 50 grand. Oh gosh. How are we going to collect those in the next 24 hours? What are your payment terms? 30 days, 15 days? How does that work for you?

Wilson (23:39):

So I’m broken down into two. We have the service side, and I also have contractual. Contractual, I’m net 30. So those are the ones I hate. The service, it’s same 24 hours. They usually within seven. I give them the leeway of seven days because we already require a deposit. So I already have skin in the game. But for the most part, when we close the job out, we’re invoicing them the same.

Adam (24:01):

I have, know a buddy of mine in town who cuts grass too, and he has a really big commercial client, he cuts the grass for them like three and a half days a week every,

Wilson (24:10):

Oh, wow.

Adam (24:11):

And I was talking to him at the end of May, and he said, this is a while ago, but he said, They haven’t paid me yet this year. And if it wasn’t for my other residential clients, I probably would go out of business. And I was like, Man, that’s rough. And so now I think he has a collections problem. I think he needs to put pressure on this group or leave him behind. But I think the mentality of a lot of our listeners is like, Well, I guess that’s just how it is. Oh, I guess that’s just, it’s a big corporation, so they’ll pay me whenever.

Wilson (24:43):

Same stuff, different day.

Adam (24:43):

Yeah. It doesn’t have to be that way. It’s only that way because you let ’em.

Wilson (24:47):

I agree. I agree. And a lot of it comes down to, once again, comes back to the industry, the culture. And now I’m going to take a step further. Me, as a Latin Hispanic, we don’t like to confront people just generally. That’s not our strong side. And I want to know if you guys are listening right now and you feel the same, it’s okay. But then we have to have those systems in place. We have to have someone who is able to follow up, make the calls, send that reminder. Because naturally, just me being someone, Latin, if you go to a job site, what are you going to see? Hey, we need this done. Yes, sir. And just work, work, work, work, work.

Adam (25:27):

Right, just get it done.

Wilson (25:28):

So now you want us, or if you’re the business owner, you’re thinking, let me confront the man who owes me. I might lose this. And it’s coming down to a scarcity mindset. Instead of a proactive conversation or just attention. You understand. And we understand in business, there’s ups and there’s downs. They may have an up. If somebody is not going to pay me, but they communicate. I’m like, Hey, bro, you let me know now I’m fine. True or not, I’m pretty sure your friend will feel the same way. He’s probably feeling that way because he’s not also getting a response from them. But if they were like, Hey, it’s tight right now, we can’t make a payment. He’s going to be like, Not a problem. I got other jobs. And positivity, move forward. It comes when there’s a lack of attention that leads to the problem.

Adam (26:11):

Yeah, communication is key. Being proactive about it. Wilson, this is a great conversation. I think there’s three actionable things that people can do right now based on what you said about debt and how to get out of debt. Number one is you have to collect and follow up on your invoices. You cannot let these invoices just age 30, 60, 90 days. You have to collect on your invoices, and you should use Jobber for that because it’s really easy, and you can see who owes you what they can pay online. And it’s super, super simple. The second thing is get a mentor who knows good systems who can help you put in place some ways to have accountability with maybe your spouse, your team. A mentor can help you see around corners that you didn’t know before. And they can also just encourage you and help you along the journey as well. And number three, look in the mirror. At the end of the day, this all comes down to you. Am I holding myself accountable? Am I doing the things that the business owner that I have to do to succeed. Take ownership, take accountability, and look in the mirror and say, I’m going to change my mindset. I’m going to change myself. I’m going to make this business better myself. Wilson, this is great. Thanks for coming on. I really appreciate it.

Wilson (27:12):

It’s really a pleasure to be here. Thank you so much.

Adam (27:14):

One more question for you. Running business is hard. What drives you? What wakes you up in the morning to say, I’m going to keep doing this, and what motivates you?

Wilson (27:21):

At the end of the day, I think we all just want to give ourselves a better opportunity. And we see something that we’re very passionate about, and we see the work that we do, and then quickly we found out how that work can turn into something you can live off of. And at the end of the day, I just want to keep going because I know what’s possible because I’ve seen what’s possible. Not only can the trades change your life, but at the same time you can hit it and change overnight. Now, success, that takes time, but anybody can get a contract. Anybody can get a house built. Anybody can rewire a burned-down building, and the next day that account can hit. The trades can give you a life that you never knew was possible. And that’s why I want to give it a hundred percent.

Adam (28:09):

Yeah, that’s awesome. Well, thanks for being here. How do people find out more about you?

Wilson (28:12):

If you want to know more about what the trades have to offer, you can follow us on Energize Us EDU on all platforms.

Adam (28:18):

Awesome. Well, thanks for being here. I think the difference that you’re making in the marketplace is awesome. I think your people are benefiting from you and your family. I think you’re having an awesome impact on the marketplace where you are. So keep it up and keep rock and rolling.

Wilson (28:31):

Thank you so much.

Adam (28:32):

On the next episode, we’re diving into how AI is actually changing the game for home service businesses. From marketing and SEO to real world tools that save time and money, you’ll hear how contractors can stay ahead of the curve before AI leaves them in the dust. Follow or subscribe today so you don’t miss out. I’m your host, Adam Sylvester. You can find me at adamsylvester.com and you can interact. I want to hear from you about what you like about the podcast. As always, your team and your clients and your family deserve your very best. So go give it to ’em.

About the speakers

Adam Sylvester

CHARLOTTESVILLE GUTTER PROS AND CHARLOTTESVILLE LAWN CARE

Website: adamsylvester.com

Adam started Charlottesville Lawn Care in 2013 and Charlottesville Gutter Pros in the fall of 2020, in Charlottesville, VA. He likes to say, “I do gutters and grass! When it rains the grass grows and the gutters leak!” He got into owning his own business because he saw it as a huge opportunity to generate great income while living a life that suited him. He believes that small companies can make a serious impact on their communities and on every individual they touch, and he wanted to build a company that could make a big difference. His sweet spot talent is sales and marketing with a strong passion for building a place his team wants to work. Adam values his employees and loves leading people. While operations and efficiency is not something that comes naturally to him, he is constantly working to improve himself and his business in these areas.

Wilson Betances

Energize Us EDU

Instagram: @energizeusedu

YouTube: Energize Us EDU

Podcast: Work & Talk Podcast

Wilson Betances is a licensed electrician who built a seven-figure electrical contracting business in four years, after realizing that he was the bottleneck of his business.

Featured in Forbes for tackling the skilled‑labor shortage , he founded Energize Us EDU to develop apprenticeships and workforce programs that builds people who build things and brings pride back to blue‑collar trades.

SIGN UP FOR PODCAST UPDATES

Get email updates on new episodes and podcast news.

You don’t want to miss out!

Interested in being a guest on the show?

Are you a home service professional eager to share your insights and experiences? Apply to be a guest on the Masters of Home Service Podcast, and join a community of experts committed to helping others level up through knowledge.

Automate admin work. Save time.

With home service software, you can take on more work without hiring more staff.

Compare plans