Starting or growing your own business costs money, and you’re not always going to have the funds available to take the next step. That’s where small business financing comes in.

Small business financing extends your runway for investing in your business by allowing you to borrow carefully and effectively.

You can use small business financing to:

- Secure a physical location for your business

- Purchase new equipment

- Pay for marketing efforts

- Hire employees

In this guide, we’ll walk you through the different types of small business financing to help you understand your options and how to choose financing for a small business.

What you need to know about small business financing:

Why financing matters for field service businesses

Small business financing matters to field services businesses because there are many startup costs and ongoing expenses that crop up in day-to-day operations, and you may not always have access to the cash you need.

It’s very normal to get financing at various stages of your business, even if you’re running a healthy and profitable company. It doesn’t mean you’ve done anything wrong or aren’t on the path to success.

For example, a landscaping company may use a business loan to alleviate the pressure of buying new and needed equipment. Or, they can use it to pay employees and do machine maintenance during the slow season. Financing helps the business stay active when there isn’t much work and gives them time to prepare for when work picks back up.

If you don’t have to constantly stress about the financial stability of your business, you can focus on providing great services, attracting more clients, and generating more revenue in the long run.

As you go through the ups and downs of running a field service business, it’s reassuring to know you can survive through slower periods with the support of small business financing.

How to get small business financing

Before we get into the specific small business financing available, it’s important to understand what lenders are looking for.

Lending requirements will vary from lender to lender, but there is common ground for what qualifies your business for financing. These general requirements include:

- Good credit score: Some lenders allow a minimum credit score as low as 600, but most are looking for 650 and up.

- Years in business: At least 1 year as an established business is enough to qualify for financing, although some lenders will allow 6 months.

- Proof of revenue: Lenders want to know that your business is generating money in order to repay the loan.

- Payment history: Depending on the type of financing, lenders will want to see a steady track record of payments from your or your clients (see invoice financing).

Types of small business financing

Once you’ve decided that financing is right for your business, it’s time to understand the options available to you.

Jobber Capital

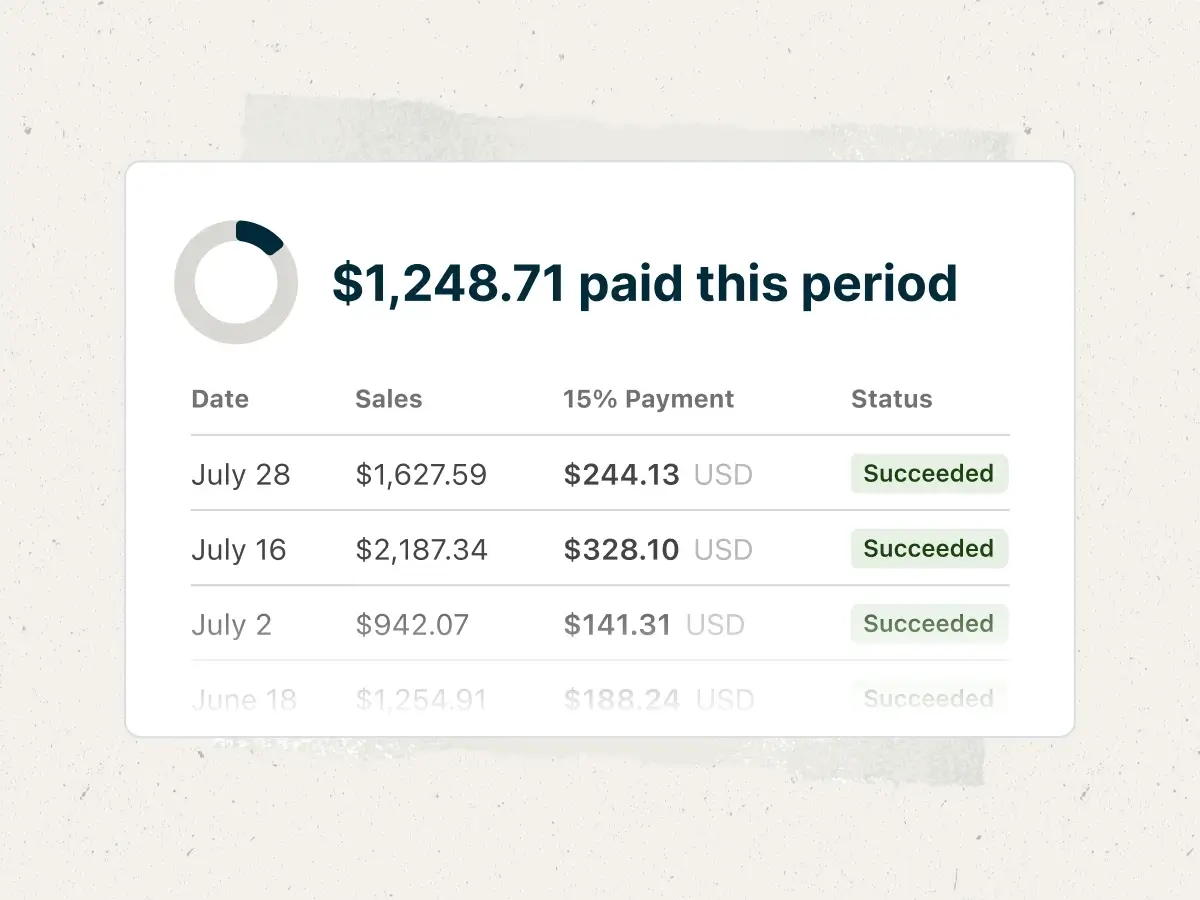

Jobber Capital is a fast and flexible way to unlock small business financing for your field services if you’re already managing your business through Jobber and Jobber Payments.

Clients using Jobber Payments with a strong revenue history can quickly apply and get approved for financing in minutes. If you need more or less than the pre-approved offer, you can customize your application by selecting the amount of financing you need.

Once your application is approved, you can expect to see the funds in your account in 1 to 2 business days. However, the time for underwriting may vary based on market conditions and other factors.

Payments are simple as well through the Jobber Capital dashboard. Based on your financing terms, you can make regular payments on a schedule, pay down the financing sooner if you have extra funds, and even make payments based on a percentage of your daily sales.

Term Loans

A term loan is a type of borrowing that comes with a lump sum payment and a structured payment schedule.

With a term loan, you’d have immediate access to the entire amount of your loan and make regular payments over the course of the term until you have repaid the full amount. Each payment includes principal and interest for the length of the borrowing term, which can range from a few months to up to 25 years.

Term loans are best for businesses looking to expand or make a large purchase. They are also great for companies with strong credit and a preference for more structured payment schedules.

| Pros | Cons |

|---|---|

| Available for many different business needs | Approvals take longer |

| Structured payment schedule | May require significant collateral |

How to qualify for a term loan: Most lenders require your business to have been in operation for at least 6 to 12 months. You may also need a credit score of at least 650, annual revenue of more than $50,000, and documentation that includes a business plan, bank statements, and tax returns.

Lines of credit

A line of credit is an account with an approved total available funds that you can use as needed for various business expenses. Much like a business credit card, you only pay back what you use, and interest is only applied to the outstanding balance instead of the full line of credit amount.

A line of credit is best for field services businesses with more seasonal fluctuation for revenue and cash flow. These businesses often need flexible access to funds at different times of the year without committing to one large lump sum.

| Pros | Cons |

|---|---|

| Flexible funds to use only what you need | Increased risk of overspending |

| No interest on unused funds | Interest rates could increase over time |

How to qualify for a line of credit: You will need to meet the lender’s minimum requirements. This varies from institution to institution, but often involves a strong credit score (above 650), proof of income, and an active account with the lender—a checking account with a bank, for example.

Invoice financing

Invoice financing allows you to get a loan based on the value of your unpaid invoices.

Invoice financing is best for businesses that wait longer to receive payments from clients and still need steady cash flow to operate—for example, landscaping, construction, or renovation companies. It’s also a useful financing tool for businesses who work with commercial or government entities that take a long time to process payments.

| Pros | Cons |

|---|---|

| Access to funds quickly | High fees from lenders |

| Strong credit not necessary | Strong credit not necessary |

How to qualify for invoice financing: You need to prove that your invoices are unpaid and not being used as collateral somewhere else. Since this type of lending is usually reserved for commercial or government clients, the lender will also want to see a consistent payment history from the client in order to trust that you’re going to receive the money and pay back the loan.

Equipment financing

Equipment financing gives you the ability to purchase equipment and pay it off over time. The equipment you buy is often used as the collateral for the financing and could be repossessed if you fail to make regular payments.

Equipment financing is best for field services businesses looking to expand their services or upgrade their tools and machinery without sacrificing too much of their cash flow.

| Pros | Cons |

|---|---|

| Equipment is the collateral | Can only be used on equipment |

| Doesn’t tie up other business funds | May need sizable down payment |

How to qualify for equipment financing: You need to provide a quote for the equipment to establish the size of the loan. You’ll also need to be in business for more than 6 to 12 months, have a credit score over 600, and show proof of revenue and the ability to make payments.

SBA loans

U.S. Small Business Administration loans are government-backed loans that give small businesses the opportunity to match with a certified lender to secure funds. SBA loans are available for long-term or short-term purposes in order to help your business at any stage of growth.

The SBA loan program is designed to help small businesses get ahead and for established businesses to grow even faster. These small business loans are best for those seeking flexible-term loans at reasonable interest rates.

| Pros | Cons |

|---|---|

| Low interest rates | Long application process |

| Longer term repayment | Not easy to qualify |

How to qualify for an SBA Loan: The application is extensive, but the requirements for an SBA loan are pretty simple. You must operate a for-profit small business in the U.S., and the business owner must have enough equity in the business to show financial stability.

How to choose the best financing option for your small business

Taking on a loan is a big decision for your business. Here’s what you need to consider before applying:

- Evaluate your needs: Get clear on what you will use the money for and how long of a loan you can manage before you bite off more than you can chew. If you have a financial advisor or accountant, make sure you speak with them first.

- Understand your current financial situation: You should know important financial details for your business like total expenses, credit score, and actual and projected revenue. This will help you decide what you need for financing and the impact it will have on your business.

- Determine when you need financing: Timing is everything when it comes to choosing the right small business financing. Do you need cash immediately? Are you planning for a larger expense in the future? These answers will narrow down your choice of financing.

Compare cost of borrowing: Even though you’re borrowing money, you still want to get the best deal. When selecting the right small business financing for you, make sure to compare interest rates, fees, and repayment terms for each of the options. - Check for eligibility: Different types of small business financing and lenders have different requirements to secure funding—credit scores, time in business, collateral, etc. Understand what your choice of financing requires before moving forward with an application.

Once you’ve taken all these areas into consideration, you’re in the best possible position to select the right type of small business financing for you.

Frequently Asked Questions

-

The requirements are different for each lending institution, but some common requirements to qualify for a small business loan are:

Strong credit score (650+)

Time as an operating business (6 to 12 months minimum)

Proof of revenue

Collateral or personal guarantee

Financial documents like tax returns and bank statements -

Most traditional loans require you to be in business for 6-12 months. So what if you’re just starting a business and need access to capital to cover your startup costs? Here are a few options to explore:

Self-funding: Investing in yourself and your business is a great place to start and shows others that you’re serious about succeeding.

Friends and family: Brush up on your pitch and share it with your closest friends and family to see if they want to participate with some “love money.”

Crowdfunding: There are plenty of platforms that allow you to source financial contributions for your business (Kickstart, GoFundMe). This works well with products or community-based projects.

Online lenders: Geared toward startups, these lenders are willing to provide funding at a cost often higher than traditional banks. -

Before applying for a small business loan or financing, you need to consider the purpose of the loan and the impact it will have on your business. This means asking important questions like:

How much money do you need?

How quickly do you need the money?

How much will the loan cost you (interest, penalties, etc.)?

Do you need any collateral?

Do you even qualify for the loan you need?

You’ll also want to compare the various types of loans—interest, payment terms, other fees required, etc.—to find what best suits you.